Even before voters cast their votes on 5 November, the 2024 US presidential election is one for the record books. After intense pressure from his own party, President Joe Biden is the first incumbent since Lyndon Johnson in 1968 not to seek re-election despite presiding over reasonable economic growth in the two years before polling day.

Vice President Kamala Harris is likely to be confirmed as the Democratic Party candidate at the party’s convention in August. In a fast-moving campaign, the latest polling shows that Harris has a better chance of beating Trump than Biden but in what is expected to be a tightly fought race, it remains to be seen whether this alters the longer-term dynamics. At the time of writing, Trump remains the favourite to win November’s election.

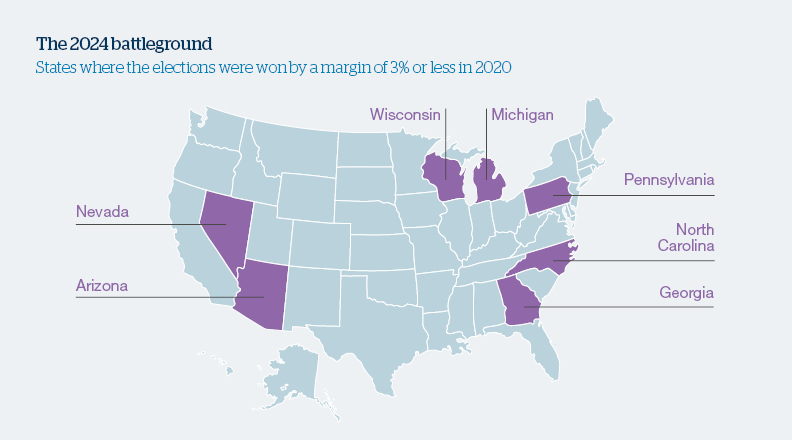

The presidential election will be decided in the ‘swing states’

The past four US presidential elections show that the popular vote, that is the total number of votes cast for each candidate, is close. Yet presidents are elected based on their vote share in the nationwide electoral college, with the first candidate to 270 declared the winner. This ‘winner takes all’ approach means that while nationwide surveys provide a useful steer, presidential elections are effectively decided in the handful of states where they are won by margins of around three percentage points.

Source: Reuters, April 2024

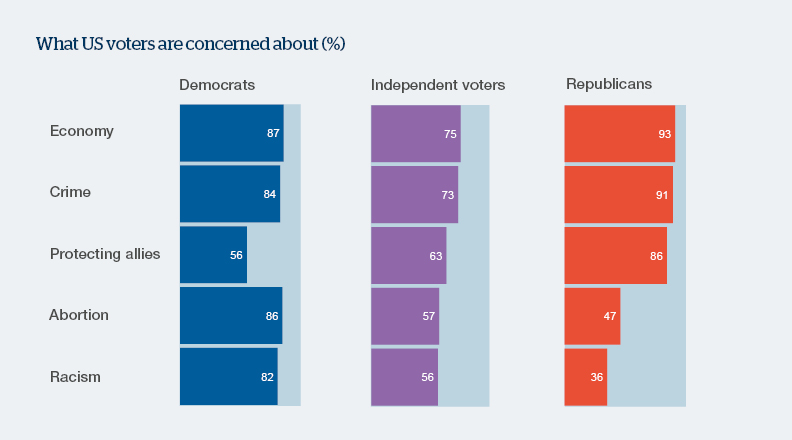

Trump won the presidential race in 2016 thanks to 77,744 votes (0.06%) of votes cast in swing states. By 2020, the pendulum had swung the other way and Biden won by an even lower 0.04% of votes cast. The high level of polarisation among voters means that we should expect another close result. In the following chart showing voters’ key concerns, while the state of the economy is the most important issue for Republicans, Democrats and Independents, those in the latter category feel less strongly than their peers on this and most of the other subjects highlighted. Independents are also less likely to vote so focusing on these ‘undecideds’ will be an important part of campaign strategies for both parties. By choosing Senator JD Vance of Ohio as his vice presidential running mate, Trump will be expecting Vance to help him ‘deliver’ the manufacturing heavy swing states in the Midwest which might be expected to benefit from Trump’s ‘America First’ policy.

Note: Reuters/Ipsos collected polling responses online nationwide via the probability-based Knowledge Panel among 4,094 U.S. adults, including 3,356 registered voters between March 7 and 13. The level of precision for each figure varies, ranging between about 1 and 4 percentage points for both polls.

Source: Reuters, April 2024

“It’s the economy, stupid”

Dating back to the 1992 US presidential campaign, the above quote continues to resonate with the electorate, as shown by the voter concerns chart above. Biden and his advisers likely counted themselves very unlucky that he was unable to convert the post-pandemic economic recovery into higher satisfaction ratings for his presidency, even as headline inflation continues to fall and unemployment hovers near 50-year lows. Voters blamed Biden as the US struggled in a post-Covid, higher inflation economy, and then failed to give him any credit when the economy did recover.

For investors meanwhile, what drives sentiment and ultimately action in the market is the economic backdrop and the actions of central banks. So while we might tactically refine our asset allocation following an election, the focus remains on the longer-term investment goals.

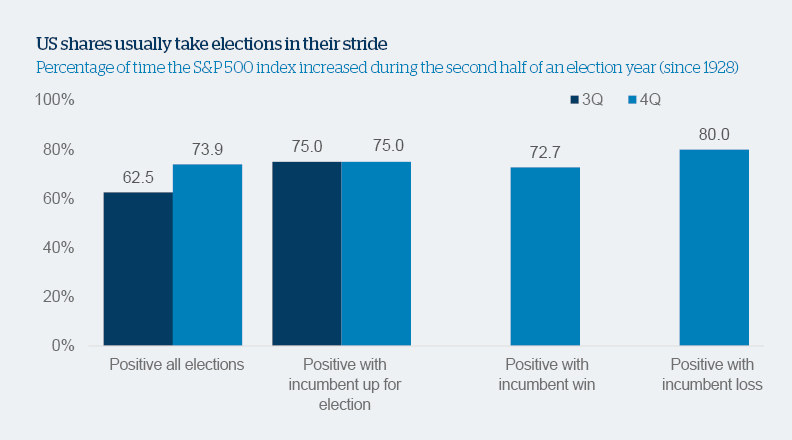

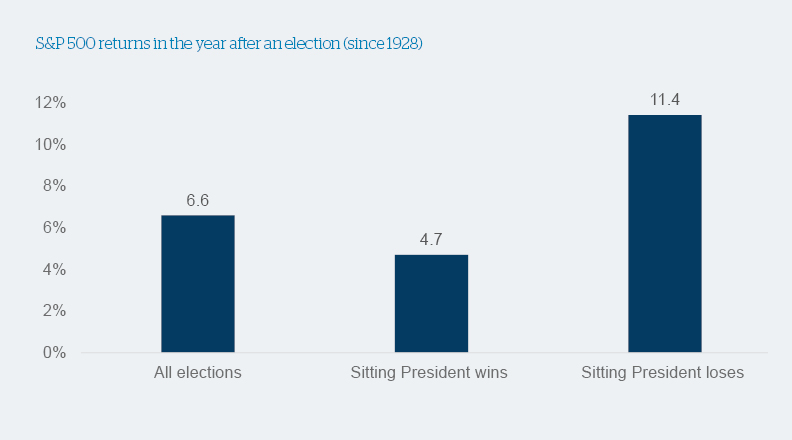

Beyond a slight preference for Republicans over Democrats, historically the US S&P 500 stock market index has risen by an average 7-10% in every US election year since 1936. With the S&P 500 already up 15% so far this year, and indicating there is a 60-70% chance of further gains in the second half irrespective of who wins, sentiment remains upbeat.

Source: Alpine Macro/Bloomberg

Source: Alpine Macro/Bloomberg

Trump 2.0 will not be a replay of Trump 1.0

In 2016, Trump campaigned on a pro-growth/low-tax manifesto and investors who positioned for this were beneficiaries. He introduced the Tax Cuts and Jobs Act (TCJA) in 2018, one of the largest tax cuts in US history the biggest of which slashed the corporate tax rate from 35% to 21%, and reduced income tax for individuals.

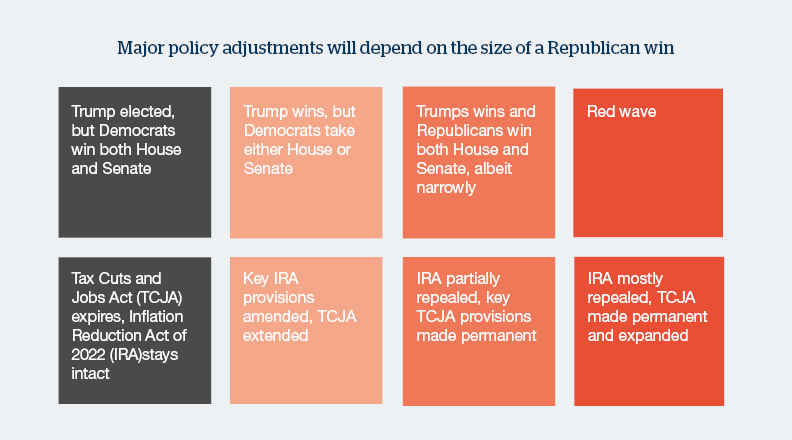

His 2024 manifesto builds on many of the same themes – less regulation, lower taxes and higher tariffs with a more pronounced ‘America First’ policy. While the TCJA reduction for corporates was permanent, those for individuals is due to expire in 2025. What happens in 2025 will depend on whether Trump wins in November, and by how much. The ease with which he can pass new legislation will depend on how much control the Republicans have in Congress.

In either of the two scenarios giving Trump control of the House and the Senate, he is likely to make the TCJA permanent though the incremental benefits will be low. Elsewhere, the IRA could be repealed by Congress. If not, solar and wind credits are likely to be trimmed and other clean energy perks dropped. Long-term investment plans by clean energy companies could be scaled back or halted as a consequence.

Some of Trump’s recent declarations are contributing to major moves in financial markets. The possibility of increasing tariffs on China and warning Taiwan it needs to pay more for its own defence (despite Taiwan being one of the largest buyers of US defence equipment), has contributed to a sell-off for the highly valued technology sector, while smaller companies represented by the Russell 2000 index have rallied strongly. The expected move by the Federal Reserve, the US central bank, to cut rates in September will also support these companies as they pay a higher rate of interest on their borrowings than do larger entities. Elsewhere, financials are expected to benefit from banking deregulation, energy from Trump’s intention to increase the production of fossil fuels, and industrials as tariffs are intended to encourage the sourcing of more domestic machinery and components. In contrast, sectors and shares linked to environmental, societal and governance themes (ESG) are expected to fare less well reflecting Trump’s statements on the matter. He has already indicated that he will (for the second time) withdraw the US from the Paris Accord on climate change.

Trump’s manifesto may also prove inflationary as tariffs will push up the prices of goods for domestic consumers, while curbing and deporting illegal migrants could push up wage growth. This would likely increase inflation and keep interest rates higher than they would be otherwise.

Source: Bloomberg; Handelsbanken Wealth & Asset Management

Voters face a stark choice in November

Voters will face a stark choice in November between two parties diametrically opposed on almost all issues, social as well as economic. Despite the impetus provided by pending interest rate cuts, the US economy is in a far weaker position than it was in 2016. The budget deficit is much bigger, increasing by almost 50% since the pandemic and the cost of servicing this debt has doubled since the last time Trump was in office. While investors will ‘look through’ the election, Trump leads in the polls, as he has done for a while. So much has happened since Trump’s first term in 2016 (Covid, record inflation, economic slowdown in China, heightened geopolitical tensions) that it provides limited guidance about what a Trump second term could look like.

As a result, while we could tactically refine our asset allocation across our investment strategies in the immediate aftermath of the election, our focus remains on our long-term investment goals and the more relevant factors driving financial markets.

Insight: Counting down to the US presidential election

Click here to view a pdf versionImportant Information

Handelsbanken Wealth & Asset Management Limited is authorised and regulated by the Financial Conduct Authority (FCA) in the conduct of investment and protection business, and is a wholly-owned subsidiary of Handelsbanken plc. For further information on our investment services go to wealthandasset.handelsbanken.co.uk/important-information. Tax advice which does not contain any investment element is not regulated by the FCA. Professional advice should be taken before any course of action is pursued.

- Find out more about our services by contacting us on 01892 701803 or exploring the rest of our website: wealthandasset.handelsbanken.co.uk

- Read about how our investment services are regulated, and other important information: wealthandasset.handelsbanken.co.uk/important-information

- Learn more about wealth and investment concepts in our Learning Zone: wealthandasset.handelsbanken.co.uk/learning-zone/

- Understand more about the language and terminology used in the financial services industry and our own publications through our Glossary of Terms: wealthandasset.handelsbanken.co.uk/glossary-of-terms/

All commentary and data is valid, to the best of our knowledge, at the time of publication. This document is not intended to be a definitive analysis of financial or other markets and does not constitute any recommendation to buy, sell or otherwise trade in any of the investments mentioned. The value of any investment and income from it is not guaranteed and can fall as well as rise, so your capital is at risk.

We manage our investment strategies in accordance with pre-defined risk objectives, which vary depending on the strategy’s risk profile.

Portfolios may include individual investments in structured products, foreign currencies and funds (including funds not regulated by the FCA) which may individually have a relatively high risk profile. The portfolios may specifically include hedge funds, property funds, private equity funds and other funds which may have limited liquidity. Changes in exchange rates between currencies can cause investments of income to go down or up.

This document has been issued by Handelsbanken Wealth & Asset Management Limited. For Handelsbanken Multi Asset Funds, the Authorised Corporate Director is Handelsbanken ACD Limited, which is a wholly-owned subsidiary of Handelsbanken Wealth & Asset Management, and is authorised and regulated by the Financial Conduct Authority (FCA). The Registrar and Depositary is The Bank of New York Mellon (International) Limited, which is authorised by the Prudential Regulation Authority and regulated by the FCA. The Investment Manager is Handelsbanken Wealth & Asset Management Limited, which is authorised and regulated by

the FCA.

Before investing in a Handelsbanken Multi Asset Fund you should read the Key Investor Information Document (KIID) as it contains important information regarding the fund including charges and specific risk warnings. The Prospectus, Key Investor Information Document, current prices and latest report and accounts are available from the following webpage: wealthandasset.handelsbanken.co.uk/fund-information/fund-information/, or you can request these from Handelsbanken Wealth & Asset Management Limited or Handelsbanken ACD Limited: 77 Mount Ephraim, Tunbridge Wells, Kent, TN4 8BS or by telephone on

+44 01892 701803.

Registered Head Office: No.1 Kingsway, London WC2B 6AN. Registered in England No: 4132340