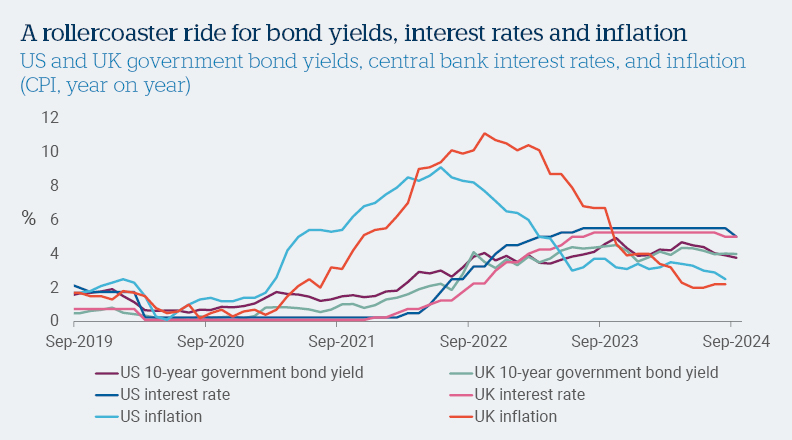

Once the global severity of the pandemic became clear in the early months of 2020, central banks around the world cut interest rates dramatically.

This is a conventional response to an extreme demand shock. However, as economies recovered from the COVID-19 crisis and inflation rose, interest rate increases became the name of the game.

Today, as rate cuts begin once more, where should we expect interest rates to settle?

Three of the most prominent central banks involved in the COVID-era rate cuts were the US Federal Reserve (Fed), the Bank of England (the BoE) and the European Central Bank (ECB). The Fed cut interest rates to a range of 0-0.25%, and the BoE to 0.10%, while the ECB was already in negative territory and kept its rate unchanged at -0.50%. These were all historic lows.

As if this was not enough to stimulate economies, these banks also used ‘quantitative easing’ (QE) in an effort to stimulate the economy, buying long-term bonds which pushed bond prices higher and yields lower (remember that bond prices and yields move in opposite directions).

Source: National Bureau of Economic Research, Bloomberg

‘Transitory’ inflation outstayed its welcome

In a lightning-fast economic plunge followed by an equally rapid recovery, interest rates and bond yields hit bottom in 2020. Economies started to respond positively to the effects of ultra-cheap funding (through low interest rates), and major economies (with the exception of China) began phased re-openings from lockdown, while commerce geared up to supply pent-up consumer demand.

Yet there was an opposite reaction on inflation, which up to that time had been subdued with the global economy partially shutdown. A key constituent was the oil price, which had fallen to a pandemic low of $16.94 per barrel in early 2020, but recovered and following the invasion of Ukraine, peaked at $120.67 per barrel in June 2022. Other upward drivers of pricing pressures included consumer demand recovering more quickly than goods could be supplied (particularly as supply chains creaked under the weight of COVID), as well as a range of expansionary policies by governments. Together, these factors fuelled a sharp rise in inflation.

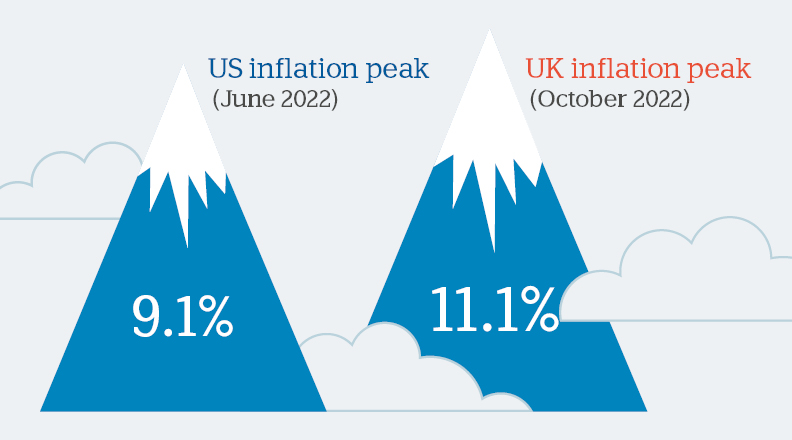

In the US, the annual rate of inflation peaked at 9.1% in June 2022, while in the UK it rose to 11.1% that October. This was an unattractive backdrop for bond markets as high inflation eroded fixed income returns. Bond yields rose sharply during 2022 and did not peak until a year later, with the benchmark US 10-year Treasury (government bond) reaching a record high of nearly 5% in October 2023.

As bond prices move in the opposite direction to yields, this presented what some investors, including ourselves, saw as an attractive buying opportunity across fixed income markets after a long period of subdued returns.

Source: National Sources

Aiming for the Goldilocks scenario

Central bankers argued that the record levels of inflation in key markets, well above the central banks’ targets, were ‘transitory’, i.e. that they were set to normalise at lower levels. Part of their thinking was that as economic shocks associated with the pandemic and war in Ukraine lessened, it was likely that disinflation (a slowdown in the rate of inflation) would occur.

This seemed perfectly possible. However, as this transitory inflation persisted, bond yields rose, sharply exacerbating the volatility in fixed income markets and resulting in some losses in bonds.

In addition to inflation, central bankers also need to take account of sustainable economic growth and high employment. This is particularly the case with the Fed. Unlike the ECB, which is tasked with maintaining price stability, or the BoE which has a 2% inflation target, the Fed has a dual mandate – ensuring price stability and maximum employment. It is for this reason that weekly US employment data (‘non-farm payrolls’) is analysed for signs of whether that economy is overheating by creating too many jobs, or not creating enough jobs and possibly slowing.

A signal from bond markets: the bell that never rang

The Fed, the BoE and the ECB started to raise interest rates, starting in 2022 and continuing into 2023. In fact this was the most aggressive and fast-paced rate hiking cycle in over forty years, which is logical given we had not seen the inflationary impulse as strong as this since the early 1980s.

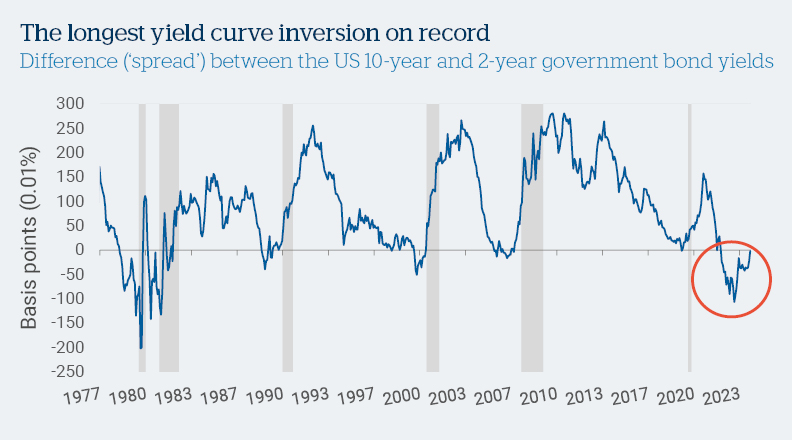

The urgency with which central banks raised interest rates was reflected in July 2022, with the start of the longest ‘bond yield curve inversion’ on record. This is when short-term Treasury yields in the US are higher than longer-dated Treasury yields, revealing investors’ belief that interest rates would remain high in the short-term, as inflation remained a problem. Conversely, the relatively lower yield on longer-term bonds signalled investors’ anticipation that interest rates would later be cut to prevent the economy slipping into recession.

Grey bars indicate periods of economic recession. Source: National Bureau of Economic Research, Bloomberg

An inverted yield curve is often seen as a portent of recession. But despite remaining inverted until September 2024, there has been no recession in the US. Indeed, the US economy had a quicker and faster recovery than elsewhere. Across the Atlantic Ocean, Europe was dragged into a recession by Germany, and the UK fell into a brief recession in the second half of 2023.

The beginning of the cutting cycle: finding the ‘neutral’ interest rate

The Fed’s decision in September 2024 to cut its main borrowing rate by 0.5% was its first such move since 2020. The decision confirmed the Fed’s view that US inflation was on its way to 2% (good), but also signalled some concerns about the slowing rate of job creation (bad).

However, the Fed was not the first developed market central bank to take action during the year – six of the ten most developed economies started cutting before the Fed, and both the BoE and the ECB cut interest rates earlier in the year, albeit by smaller increments.

Nevertheless, it is the Fed’s move that is the most significant, signalling that the world’s strongest economy thinks the era of unusually high inflation is coming to an end. It recently lowered its inflation outlook to 2.3% from 2.6%.

Attention will now be on establishing the optimal level for interest rates, also known as the neutral rate. This is a theoretical interest rate which supports full employment as well as a stable growth and inflation outlook. Unfortunately, since the neutral rate is a theoretical concept, it cannot be measured. It will also adjust constantly to prevailing economic conditions.

Every quarter (three-month intervals throughout the year), the Fed issues its quarterly ‘dot plot’, which records each member of the Fed’s ruling committee’s estimate of where the key ‘Fed funds’ interest rate will be in December over the next few years. The latest ‘dot plot’ indicates a more aggressive anticipated path to rate cuts than estimated earlier in the year.

For now, the consensus seems to be that the neutral US interest rate will be around 2.9% – materially higher than in the period since the global financial crisis of 2007-8, and higher than the levels to which consumers have grown accustomed.

Where do we go from here?

US economic growth (as measured by gross domestic product) is still growing, but at a slower pace. It remains unclear whether this is merely a response to lessened economic stimulus from the government, or something more serious. Certainly, the last time the Fed made such an outsized rate cut (excepting the emergency cuts during the pandemic) was during 2008’s global financial crisis.

As for employment, which has now overtaken inflation as the Fed’s priority, we expect to see some weakening in labour markets, but this is likely to be less severe than during memorable recent recessions.

The health of the dominant US economy is critical to global economic health. However, elsewhere, there are also signs of an economic recovery in both the UK and Europe. On a relative basis, though, their recovery trajectory looks more limited given their persistent structural growth issues, more restrictive government expenditure and their vulnerability to any slowing in the US economy.

From an investment perspective, we are mindful of the potentially negative balance of risk at work in the global economy. It will take time – perhaps months – for interest rate cuts to feed through into the real economy.

With this in mind, our current highest conviction views include:

- A positive stance on government bonds, with a preference for UK government bonds in particular.

- Corporate debt, with a preference for investment grade (higher quality) debt over high yield (lower quality) debt. We’ve also reduced our emerging market debt position to reflect the size of the investable marketplace, and in expectation of a regional economic downturn.

If you’d like to find out more about our views on investment markets or the economic outlook, please contact us.

Insight: Do we need to get used to higher interest rates?

Click here to view a pdf versionImportant Information

Handelsbanken Wealth & Asset Management Limited is authorised and regulated by the Financial Conduct Authority (FCA) in the conduct of investment and protection business, and is a wholly-owned subsidiary of Handelsbanken plc. For further information on our investment services go to wealthandasset.handelsbanken.co.uk/important-information. Tax advice which does not contain any investment element is not regulated by the FCA. Professional advice should be taken before any course of action is pursued.

- Find out more about our services by contacting us on 01892 701803 or exploring the rest of our website: wealthandasset.handelsbanken.co.uk

- Read about how our investment services are regulated, and other important information: wealthandasset.handelsbanken.co.uk/important-information

- Learn more about wealth and investment concepts in our Learning Zone: wealthandasset.handelsbanken.co.uk/learning-zone/

- Understand more about the language and terminology used in the financial services industry and our own publications through our Glossary of Terms: wealthandasset.handelsbanken.co.uk/glossary-of-terms/

All commentary and data is valid, to the best of our knowledge, at the time of publication. This document is not intended to be a definitive analysis of financial or other markets and does not constitute any recommendation to buy, sell or otherwise trade in any of the investments mentioned. The value of any investment and income from it is not guaranteed and can fall as well as rise, so your capital is at risk.

We manage our investment strategies in accordance with pre-defined risk objectives, which vary depending on the strategy’s risk profile.

Portfolios may include individual investments in structured products, foreign currencies and funds (including funds not regulated by the FCA) which may individually have a relatively high risk profile. The portfolios may specifically include hedge funds, property funds, private equity funds and other funds which may have limited liquidity. Changes in exchange rates between currencies can cause investments of income to go down or up.

This document has been issued by Handelsbanken Wealth & Asset Management Limited. For Handelsbanken Multi Asset Funds, the Authorised Corporate Director is Handelsbanken ACD Limited, which is a wholly-owned subsidiary of Handelsbanken Wealth & Asset Management, and is authorised and regulated by the Financial Conduct Authority (FCA). The Registrar and Depositary is The Bank of New York Mellon (International) Limited, which is authorised by the Prudential Regulation Authority and regulated by the FCA. The Investment Manager is Handelsbanken Wealth & Asset Management Limited, which is authorised and regulated by

the FCA.

Before investing in a Handelsbanken Multi Asset Fund you should read the Key Investor Information Document (KIID) as it contains important information regarding the fund including charges and specific risk warnings. The Prospectus, Key Investor Information Document, current prices and latest report and accounts are available from the following webpage: wealthandasset.handelsbanken.co.uk/fund-information/fund-information/, or you can request these from Handelsbanken Wealth & Asset Management Limited or Handelsbanken ACD Limited: 77 Mount Ephraim, Tunbridge Wells, Kent, TN4 8BS or by telephone on

+44 01892 701803.

Registered Head Office: No.1 Kingsway, London WC2B 6AN. Registered in England No: 4132340