In the current environment of high prices and rising interest rates, saving for retirement can seem little short of a luxury. But with state pensions increasingly deemed insufficient for a comfortable retirement, private pension savings are becoming an ever more critical part of long-term financial planning.

Against the backdrop of a well-publicised ‘cost of living’ crisis, concerns are growing that many people have paused or cancelled their regular contributions to their pension savings. Why is this so worrying, and are there ways to work around these competing financial priorities?

Why should I prioritise pension savings?

There is competition for our financial resources at all stages of life, but these competing priorities are often most acute early in one’s career. Amid aspirations like saving to get onto the property ladder and paying down student loans, or the expenses associated with a growing family, pension savings can often take a backseat. This is unfortunate, as the contributions you make to your pension scheme in the earliest years have the longest period in which to attract investment growth, in turn making the largest contribution to your overall pension fund over time.

It’s important to remember that no investment ever comes without risk, but workplace pensions and private pensions are widely accepted as good long-term options for building up your retirement savings. If you work for a company in the UK, then your employer is already paying into your pension on your behalf, but you can make additional contributions yourself. Similarly, if you are paying into a separate private pension, the higher your payments into the scheme, the better the chance that you will accrue a healthier pension pot over the long term.

You should of course think carefully about whether or not you can afford to make additional payments, and we would always recommend taking advice to ensure that you understand the risks, limitations and processes involved. But what are the potential benefits?

- Paying extra into your pension can help you to build your retirement savings more quickly. The additional time these savings spend in your pension pot also means they can be put to work for much longer in search of growth.

- You can claim tax relief on contributions to private pensions, including additional contributions to workplace pensions, worth up to 100% of your annual earnings.

- Some employers will match the additional contributions you make to your workplace pension. This can supercharge your retirement savings – think of it like a pay rise for your future self, while your present self makes the most of the associated tax relief.

Should I pause my pension savings to prioritise shorter-term needs?

In theory, at a later point in your life/career, you are likely to have access to a greater amount of disposable income. Perhaps your mortgage has been paid off entirely, or paid down to such an extent that your monthly payments are much lower. This is often a time when retirement seems nearer, creating a greater sense of urgency around savings.

However, the rising cost of living is making it challenging to commit to pension savings. As energy and food bills rise, many savers are looking carefully at their regular outgoings and prioritising their more immediate needs. Most recognise that saving adequately for retirement is key to their financial planning, but money can only stretch so far, and for many it ranks lower down the priority list when finances are stretched.

A couple of decades ago, hefty penalties may have been incurred if pension contributions were paused or stopped completely. This is no longer the case, meaning that contributions to a personal pension can be paused for a period, if your finances cannot stretch to cover them. If you’re considering pausing your pension savings, which pitfalls should you watch out for?

- Some workplace pension schemes include provision for a minimum employee contribution, in which case pausing your own payments could also lead to the loss of the employer’s contribution. (If you’re making the kind of additional voluntary contributions outlined above, it should be possible to simply cease making these until such time as they are affordable again.)

- When it comes to ‘defined benefit’ schemes, detailed advice should be sought before ceasing your contributions, as in some cases it may not be possible to re-join the scheme, and any new membership may be on less favourable terms.

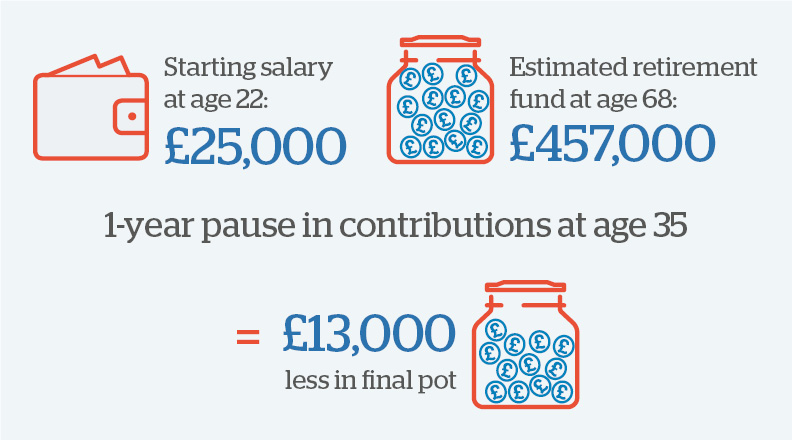

- Since the benefits of your savings should accumulate over time, any pausing of contributions can have a material impact on your final pension benefits.

These are just a few issues to consider, and we would strongly recommend that you take advice before coming to a decision.

These are just a few issues to consider, and we would strongly recommend that you take advice before coming to a decision.

Source: Standard Life. Assumes standard auto-enrolment contributions (3% employee, 5% employer).

Can I make up for lost pension savings later?

There’s no doubt that this is a difficult savings environment, but making up for lost pension contributions further down the line can be challenging. Even a short pause can make a surprisingly large dent in your retirement funds.

Rather than ceasing to make pension contributions entirely, it may be more sensible to consider whether these can be reduced to a more affordable level for the time being. If this is not possible, then try to have a clear aim as to when you can restart your pension contributions, and if feasible and sustainable, restart at an increased level to help to make up the shortfall.

It is possible to carry forward unused annual pension allowances from the previous three tax years. In any single year, you can contribute up to a maximum of 100% your earnings, so when combined these allowances can be quite sizeable. You must use up the current year’s allowance first, before looking back to the earliest of the three previous tax years and topping up to the annual allowance/maximum limit for that year (taking account of any contributions already made in any given year). This can be quite complicated and we recommend seeking good financial advice before committing to a course of action.

What if I don’t want to lock my money away?

Pension schemes are attractive prospects for their generous tax relief and long-term tax-free potential growth prospects. However, these savings can seem very ‘locked away’, and many people are uncomfortable about the idea of building up savings to which they won’t have access until their late 50s (under current legislation). What if, once set aside, that money is suddenly required for short-term needs?

If inaccessible savings are thoroughly beyond your comfort zone, then there are alternative approaches to building savings in a tax efficient way, whilst keeping that money accessible to you in the short term. For example, individual savings accounts (commonly known as ISAs) offer tax free savings. ISAs do not offer the tax relief benefits of pension contributions, but by foregoing tax relief over the shorter term, ISA savers can build their savings in a more accessible way. If – further down the line – you find that you can afford to part with these funds after all, it may be worth adding these to your pension pot as a lump sum contribution. Again, we would recommend taking good financial advice before acting.

Important Information

Handelsbanken Wealth & Asset Management Limited is authorised and regulated by the Financial Conduct Authority (FCA) in the conduct of investment and protection business, and is a wholly-owned subsidiary of Handelsbanken plc. For further information on our investment services go to wealthandasset.handelsbanken.co.uk/important-information. Tax advice which does not contain any investment element is not regulated by the FCA. Professional advice should be taken before any course of action is pursued.

- Find out more about our services by contacting us on 01892 701803 or exploring the rest of our website: wealthandasset.handelsbanken.co.uk

- Read about how our investment services are regulated, and other important information: wealthandasset.handelsbanken.co.uk/important-information

- Learn more about wealth and investment concepts in our Learning Zone: wealthandasset.handelsbanken.co.uk/learning-zone/

- Understand more about the language and terminology used in the financial services industry and our own publications through our Glossary of Terms: wealthandasset.handelsbanken.co.uk/glossary-of-terms/

All commentary and data is valid, to the best of our knowledge, at the time of publication. This document is not intended to be a definitive analysis of financial or other markets and does not constitute any recommendation to buy, sell or otherwise trade in any of the investments mentioned. The value of any investment and income from it is not guaranteed and can fall as well as rise, so your capital is at risk.

We manage our investment strategies in accordance with pre-defined risk objectives, which vary depending on the strategy’s risk profile.

Portfolios may include individual investments in structured products, foreign currencies and funds (including funds not regulated by the FCA) which may individually have a relatively high risk profile. The portfolios may specifically include hedge funds, property funds, private equity funds and other funds which may have limited liquidity. Changes in exchange rates between currencies can cause investments of income to go down or up.

Registered Head Office: No.1 Kingsway, London WC2B 6AN. Registered in England No: 4132340