Inheritance tax (IHT) is a highly emotive topic, and a lucrative matter for the government. According to HMRC, the UK Treasury received more than £5.3bn in income from IHT from April to December 2022.

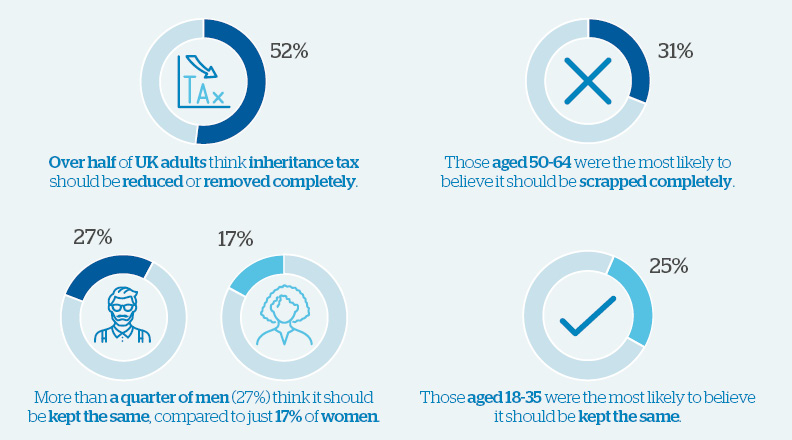

With the threshold at which estates become liable for IHT frozen until 2028, and inflation high, an increasing number of estates will be required to pay IHT in the coming years. Little surprise, then, that 52% of UK adults would like to see IHT scrapped, or at least reduced, according to our research*.

As part of the 2022 Autumn Statement, the UK government made the decision to maintain the IHT ‘nil rate’ band threshold at £325,000 until 2028. To reiterate, this is the point at which estates become large enough to be deemed liable to pay IHT (currently payable at a rate of 40% of the estate’s value). Meanwhile, asset prices (including property prices) have been rising: as more estates rise in value, more will move beyond the threshold for IHT, further increasing government income from this unique tax avenue.

Indeed, HMRC figures show that income from IHT for the 2021/22 tax year reached a record £6.1bn. This marked a 14% (£729m) increase on the previous tax year – the largest single-year increase since 2015/16.

What did our survey tell us about views on IHT?

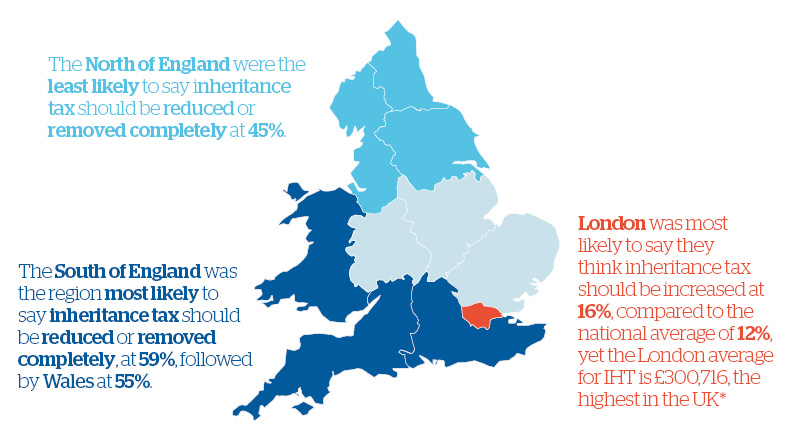

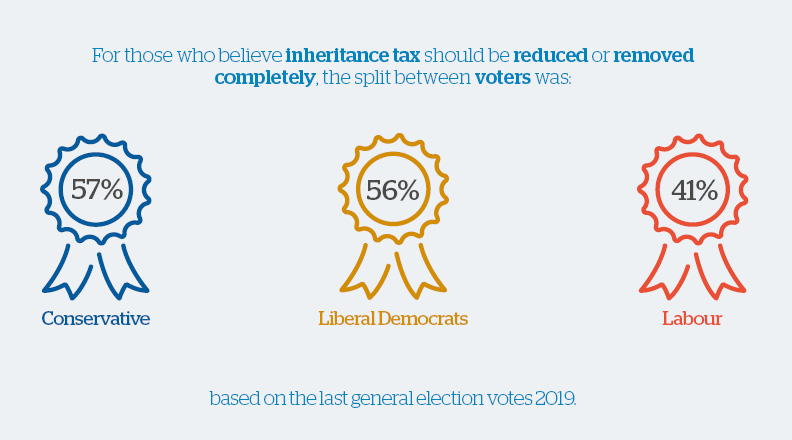

Our survey covered 2,000 adults around the country, and revealed strong feelings about IHT, as you can see below. While there was plenty of common ground, we also saw divergence along political lines, by age and gender groups, and by location around the country.

Source: Handelsbanken Wealth & Asset Management

Will IHT ever be scrapped?

It’s clear that cutting or dropping IHT would be a popular move, but it’s probably safe to rule out the scrapping/reduction of IHT in the short term, given the current debate about government spending and tax cuts.

IHT income for the government is at an all-time high (both in terms of the total amount received, and as a percentage of GDP), underlining its importance to government funding. IHT income for the government reached £6.1bn for the tax year 2021/2022, and forecasts indicate that this will rise to more than £6.7bn in the current tax year (2022/2023) – a potentially critical resource as the government looks to reduce its spending and make back some of the funding paid out over the COVID-19 era.

How should I manage my exposure to IHT liabilities?

Like much of the tax system, IHT rules are not especially straightforward. Besides the £325,000 nil rate band, anyone leaving their property to direct descendants is entitled to an extra £175,000 ‘residential nil rate band’, assuming their estate does not exceed £2 million. This enables an estate to reach £500,000 before becoming liable for IHT. Further, if someone dies and leaves their estate to their spouse or civil partner, their spouse/civil partner will not pay IHT on this inheritance. Indeed, they will then be able to add the unused percentage of their own allowance to their spouse/civil partner’s, enabling them to pass on up to a combined £1m before IHT kicks in.

We believe that the nuanced detail around IHT legislation only serves to further highlight the importance of seeking good financial advice. As ever, we recommend regularly reviewing your affairs to ensure that you are managing your wealth in the most tax-efficient way possible, and keeping your long-term needs at the forefront of your plan.

*based on HMRC figures

Source: Handelsbanken Wealth & Asset Management

* Study conducted by independent research company Opinion among a nationally and politically representative sample of 2,000 UK adults aged 18-plus between September 21st and 23rd 2022 using an online methodology.

Important Information

Handelsbanken Wealth & Asset Management Limited is authorised and regulated by the Financial Conduct Authority (FCA) in the conduct of investment and protection business, and is a wholly-owned subsidiary of Handelsbanken plc. For further information on our investment services go to wealthandasset.handelsbanken.co.uk/important-information. Tax advice which does not contain any investment element is not regulated by the FCA. Professional advice should be taken before any course of action is pursued.

- Find out more about our services by contacting us on 01892 701803 or exploring the rest of our website: wealthandasset.handelsbanken.co.uk

- Read about how our investment services are regulated, and other important information: wealthandasset.handelsbanken.co.uk/important-information

- Learn more about wealth and investment concepts in our Learning Zone: wealthandasset.handelsbanken.co.uk/learning-zone/

- Understand more about the language and terminology used in the financial services industry and our own publications through our Glossary of Terms: wealthandasset.handelsbanken.co.uk/glossary-of-terms/

All commentary and data is valid, to the best of our knowledge, at the time of publication. This document is not intended to be a definitive analysis of financial or other markets and does not constitute any recommendation to buy, sell or otherwise trade in any of the investments mentioned. The value of any investment and income from it is not guaranteed and can fall as well as rise, so your capital is at risk.

We manage our investment strategies in accordance with pre-defined risk objectives, which vary depending on the strategy’s risk profile.

Portfolios may include individual investments in structured products, foreign currencies and funds (including funds not regulated by the FCA) which may individually have a relatively high risk profile. The portfolios may specifically include hedge funds, property funds, private equity funds and other funds which may have limited liquidity. Changes in exchange rates between currencies can cause investments of income to go down or up.

Registered Head Office: No.1 Kingsway, London WC2B 6AN. Registered in England No: 4132340