Below, we outline some of our key views on the factors set to drive financial markets over the coming months, and what this means for our investment strategies.

What's next for the global economy and financial markets?

Economic growth is budding (unevenly) across the globe

Green shoots of economic recovery are tentatively appearing in regions like Europe and the UK following a period of relatively mild recession. This includes early signs of improvement in the manufacturing sector and credit markets. The picture is slightly different in the US, where despite some very recent slightly weaker employment figures, a surprisingly robust jobs market has helped to keep economic activity quite buoyant over the past couple of years. (Similar decoupling is also apparent between developing countries, with China’s economy faltering while the Indian economy thrives.)

Stubbornly high pockets of inflation present a dilemma for central banks

In response to concerted efforts by the world’s leading central banks to bring inflation to heel (by raising interest rates to slow down economic activity), pricing pressures have been falling back in recent months. However, the journey down from multi-decade highs for inflation was never likely to be smooth, and pockets of stubborn pricing pressures have persisted, such as in areas like housing. This is a challenge for central banks, who must decide when (and by how much) to begin lowering interest rates. If they move too soon, they could endanger the move away from higher inflation; move too late, and they could damage the growth of the economy.

Interest rate cuts are still coming, but investors have lowered their expectations

In the opening months of the year, investors have been assessing this challenging economic landscape, and trying to chart a way through it. In practice, this has meant revisiting (repeatedly) expectations for the timing and scale of interest rate cuts from leading central banks in 2024. Back in January, hopes were high that the first interest rate cuts would begin in spring, before being peppered throughout the rest of the year. Stubborn inflation has tempered these expectations: investors still expect interest rate cuts this year, but not at the pace and magnitude previously envisioned. It’s now widely expected that interest rates will be cut on this side of the Atlantic (in the UK and Europe) before the US central bank makes its first move.

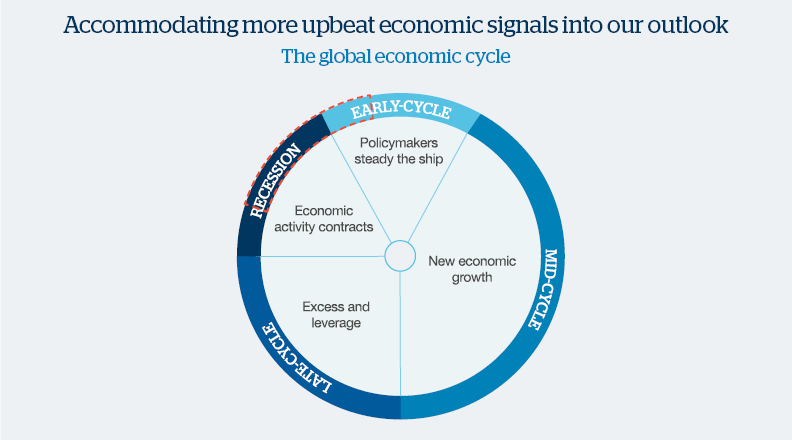

Our chart of the month

Source: Handelsbanken Wealth & Asset Management

What does this chart tell us?

This chart shows the global economic cycle – the regular fluctuations between periods of growth (expansion) and recession (contraction). The highlighted segment represents our outlook for the coming 12-month period.

We are encouraged by green shoots of recovery emerging (in areas like credit markets and the manufacturing sector), alongside a sense that the global growth is acclimatising and inflation normalising. This has led us to feel quietly and cautiously optimistic. As a result, we have slightly shifted our outlook for the global economy from recession towards ‘early-cycle’.

- We’ve recently slightly increased our stock market positions to reflect our view that we are approaching the later stages of a period of recession. We achieved this by reducing our positions in a number of other market areas, most notably alternative asset types and debt in developing economies.

- Within our stock market positions, we favour the shares of smaller and mid-sized businesses, as well as positions in healthcare, insurance and clean energy. With a few key exceptions, we currently prefer to limit the bulk of our stock market exposure to developed economies.

At the time of this update, we are 'neutral' when it comes to stock markets/shares. This means that we have not deviated for tactical reasons from our asset allocation framework - a way of dividing investments across different types of assets. As a result, our multi asset strategies currently hold a proportion of investments in stock markets which is consistent with our long-term average.

- Our multi asset investment strategies currently hold a higher proportion of assets in ‘fixed income’ markets (like government bonds) versus our long-term average positions. Having been a rather uninteresting part of financial markets for quite some time, bond yields rose higher in 2023 than they had done for many years (and bond prices, which always move in the opposite direction to yields, fell). This presented what we perceived to be an attractive buying opportunity.

- Building up our bond exposure has meant not only increasing the proportion of bonds that our strategies hold, but also the maturity of these bonds, particularly UK government bonds. Adding longer-maturity bonds gives us a greater sensitivity to movements in expectations for interest rates, and we continue to believe the market is underappreciating how much the Bank of England in particular will cut interest rates over the next 12-18 months.

At the time of this update, we are slightly 'overweight' bond market investments. This means that we have deviated for tactical reasons from our asset allocation framework - a way of dividing investments across different types of assets. As a result, our multi asset strategies currently hold a relatively larger proportion of investments in bond versus our long-term average.

- The ‘alternative’ investment space covers a diverse range of assets outside of traditional bond and stock markets, from commercial property to specialist hedge funds.

- Because of their huge variety, it’s difficult to make sweeping statements about alternative assets, and our overall ‘underweight’ stance in this diverse area of the markets hides some specific preferences. At present, we have a preference for assets which can drive financial returns, without being closely linked to mainstream financial markets. Current notable holdings include a specialist hedge fund designed to protect against dramatic market falls.

At the time of this update, we are slightly 'underweight' alternative assets. This means that we have deviated for tactical reasons from our asset allocation framework - a way of dividing investments across different types of assets. As a result, our multi asset strategies currently hold a relatively smaller proportion of investments in alternative assets versus our long-term average.

If you’d like further information on how we divide investments in our strategies across different types of assets (i.e. our asset allocation framework, and our tactical deviations away from it), please contact us.