We know that, broadly speaking, women convey a lower level of financial confidence. Our annual Wealth Surveys have repeatedly shown that women feel they have a limited understanding of financial products, and that they’re less confident in their financial decision-making.

Does this impact their willingness to take on financial risk in search of financial reward, and what does this mean for the gender wealth gap?

The results of our 2024 Wealth Survey are in, and the simple truth is that across the UK, and across genders, our understanding of financial products is low.

The financial products that most of us have the worst understanding of include investments, pensions, and personal insurance products. Worryingly, women of all ages are more likely than their male counterparts to state limited or no understanding of these products. For example, 43% of men told us that they had limited understanding of investments, but this figure rose to 69% for women. This is a consistent pattern, with our 2023 and 2024 Wealth Surveys delivering similar results.

Lucy Allington, Client Director at Handelsbanken Wealth & Asset Management, says that this evidence of a widespread lack of understanding surrounding financial products is extremely concerning, but that the gender differences are sadly unsurprising:

“The financial world has a long history of overtly excluding women, and this has certainly taken its toll. A number of the women reading this report will remember a time when they did not have the right to open a bank account or credit card, or take out a loan or mortgage, without the authorisation of a male guarantor. Incredibly, this did not change until the 1970s!

Thankfully, we’re now living in a very different world, but the damage caused by that era will take time to undo. As a result, it shouldn’t come as a shock to discover that we’re still seeing stark gender differences in financial literacy. As a wealth adviser, it’s part of my job to help to bridge the gap.”

In keeping with last year’s results, a higher level of affluence appears to close some of the financial literacy gap. Women with financial assets over £100,000 are most likely to have a good understanding of financial products - in particular investments. However, wealthier women are still more likely than wealthy men to be apprehensive about investments and pensions.

Where does poor financial confidence come from?

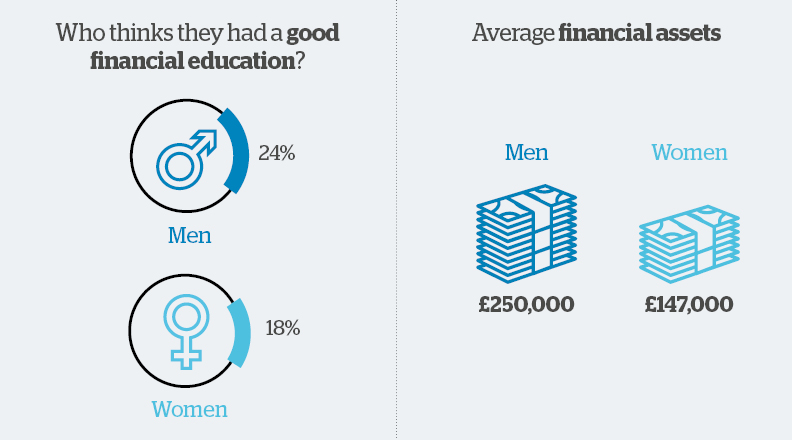

Looking back to when they were younger, just a fifth (21%) of our survey respondents claim to have received a good education on managing money in school. Breaking this down by gender, this equates to 24% of men versus just 18% of women. As a professional adviser, Lucy finds these figures very concerning, especially in an era when people are being encouraged to take more control over their financial futures.

Source: Handelsbanken Wealth & Asset Management Wealth Survey 2024

Change may be afoot, though, as younger generations are more likely to believe that they’ve had a good financial education (36% for 18-29 year olds) versus older age groups (14% for those over 50 years old). However, breaking it down by gender again, it’s clear that even among younger age groups, men feel more confident than women about the financial education they’ve received. 46% of men under 30 believe they received a good education on managing money compared to 28% of women the same age.

Source: Handelsbanken Wealth & Asset Management Wealth Survey 2024

Lucy sees both good and bad news in this data:

“I do see some causes for celebration among younger women’s views of their own financial literacy, and I hope that in twenty years’ time we’ll be looking at a very different picture.

“However, the financial literacy figures for more mature women today are a huge concern. I want these women to know that it’s not too late to receive the financial education they deserve. It can seem overwhelming, but we’d really encourage everyone to take full advantage of accessible learning opportunities, from events at your local bank branch to one-to-one conversations with a professional wealth adviser. You might be surprised by how quickly you can build up your knowledge and confidence, given the right tools.”

How do we feel about risky investments?

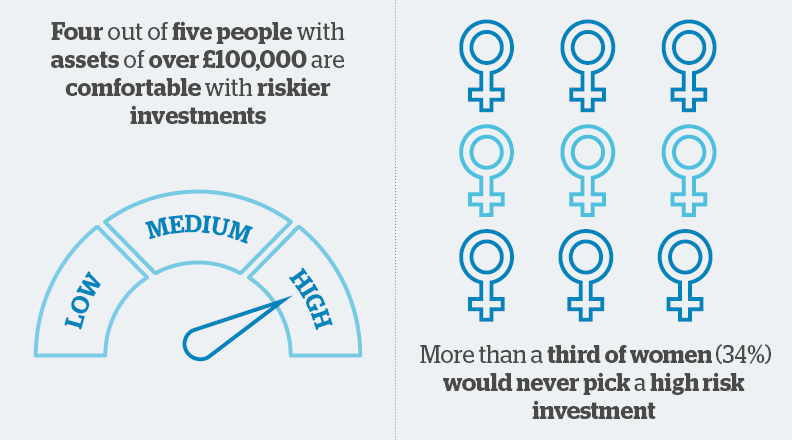

Our survey suggested that most people prefer lower risk investment options. When asked to imagine picking an investment with the potential for large gains alongside the risk of large losses, 15% said that they would feel panicked and very uncomfortable. A further 27% said they would feel quite uneasy.

Tellingly, wealthier individuals were more likely to be comfortable with the idea of higher risk investment options. 82% of people with assets of over £100,000 felt comfortable with a higher risk product in their search for higher returns, compared with just 68% of those with assets under £100,000.

Women were more risk-averse than men, with nearly half saying they felt either quite uneasy or panicked and very uncomfortable by high-risk options. By contrast, only 10% of men said they would feel this way. More than a third of women said they would never pick a high-risk investment.

These findings completely chime with what Lucy has witnessed in practice as a wealth adviser, and her awareness surrounding these issues has recently been heightened:

“Since our first Wealth Survey in 2023, whenever I speak to a mixed-gender couple about their investment options, I’m more aware than ever of their potentially differing feelings about taking on risk.

“Interestingly, I often get the feeling that women are much more open than men when it comes to admitting their reservations. Perhaps, for men, a little bravado can creep in! Making sure that everyone’s voices are heard equally can therefore be really helpful in checking that everyone is truly comfortable with the risks they’re taking on in search of financial returns.”

Source: Handelsbanken Wealth & Asset Management Wealth Survey 2024

Is a lower tolerance for risk contributing to the gender wealth gap?

Study after study has shown that men are more likely to invest their capital than women, with women more inclined to keep money in straightforward savings accounts rather than putting it to work in financial markets. As a result, even men and women with similar incomes can end up with quite different wealth levels over time. Could getting more comfortable with risk help to close the gender wealth gap?

Lucy points out:

“No investment comes without risk, and that’s certainly true for investment in shares, bonds and other financial market instruments. However, as a business that specialises in building long-term financial plans, I would encourage everyone to think about what they need their money to help them achieve over the long run. Focusing on short-term certainty, such as interest rate returns on cash savings, can make you feel safe in the near term, but could leave your longer-term aspirations out of reach.

“Yes, staying out of financial markets removes your exposure to financial market risk, but it also means missing out on the potential to build up financial returns over the long-run. Meanwhile, inflation can make your cash savings worth much less in the future, picking your pocket over time. Unfortunately, there’s no such thing as a free lunch: there’s simply no gain without risk.”

Getting comfortable with financial market risk

- Closing the gender wealth gap could involve women becoming more comfortable about the risks involved in investing

- Be honest with your adviser about your financial knowledge, your goals, and your tolerance for risk

- Make sure you understand what you’re invested in – if your financial adviser can’t explain it to you, it’s time to look elsewhere

Is lower confidence widening the gender wealth gap?

Click here to view a pdf versionImportant Information

Handelsbanken Wealth & Asset Management Limited is authorised and regulated by the Financial Conduct Authority (FCA) in the conduct of investment and protection business, and is a wholly-owned subsidiary of Handelsbanken plc. For further information on our investment services go to wealthandasset.handelsbanken.co.uk/important-information. Tax advice which does not contain any investment element is not regulated by the FCA. Professional advice should be taken before any course of action is pursued.

- Find out more about our services by contacting us on 01892 701803 or exploring the rest of our website: wealthandasset.handelsbanken.co.uk

- Read about how our investment services are regulated, and other important information: wealthandasset.handelsbanken.co.uk/important-information

- Learn more about wealth and investment concepts in our Learning Zone: wealthandasset.handelsbanken.co.uk/learning-zone/

- Understand more about the language and terminology used in the financial services industry and our own publications through our Glossary of Terms: wealthandasset.handelsbanken.co.uk/glossary-of-terms/

All commentary and data is valid, to the best of our knowledge, at the time of publication. This document is not intended to be a definitive analysis of financial or other markets and does not constitute any recommendation to buy, sell or otherwise trade in any of the investments mentioned. The value of any investment and income from it is not guaranteed and can fall as well as rise, so your capital is at risk.

We manage our investment strategies in accordance with pre-defined risk objectives, which vary depending on the strategy’s risk profile.

Portfolios may include individual investments in structured products, foreign currencies and funds (including funds not regulated by the FCA) which may individually have a relatively high risk profile. The portfolios may specifically include hedge funds, property funds, private equity funds and other funds which may have limited liquidity. Changes in exchange rates between currencies can cause investments of income to go down or up.

Registered Head Office: No.1 Kingsway, London WC2B 6AN. Registered in England No: 4132340