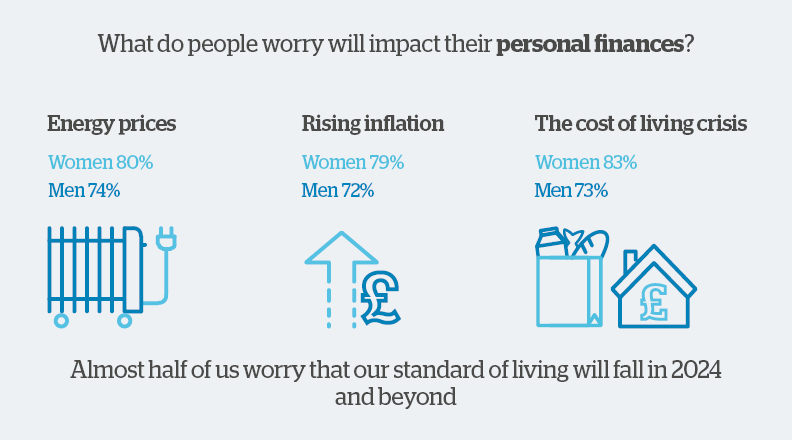

From wishing we’d saved for retirement earlier in life, to panicking about the higher cost of living, there are plenty of worries to keep us awake at night. But what did our Wealth Survey reveal about the different worries faced by different age groups and genders, and – more optimistically – which financial decisions have made us most proud of ourselves?

Our Wealth Survey revealed that people in the UK expect to spend extra time managing their finances in 2024 than they did in the past. 41% of people claimed that they are likely to spend longer reviewing their spending on groceries, utility bills and household finances, with men expecting to spend more time than women reviewing their financial commitments.

Source: Handelsbanken Wealth & Asset Management Wealth Survey 2024

In keeping with the pattern we saw in last year’s Wealth Survey results, women appear more likely to have oversight of day-to-day household finances like groceries and bills, while men were more likely to have responsibility for longer-term financial products such as credit cards, subscription services, pensions and investments. As we noted in last year’s report (and in the first chapter of this report), this is in keeping with the historical image of women managing households and – by extension – household budgets, whilst being largely excluded from the ‘male’ world of formal financial products and services.

Source: Handelsbanken Wealth & Asset Management Wealth Survey 2024

Politics are a hot topic in an election year

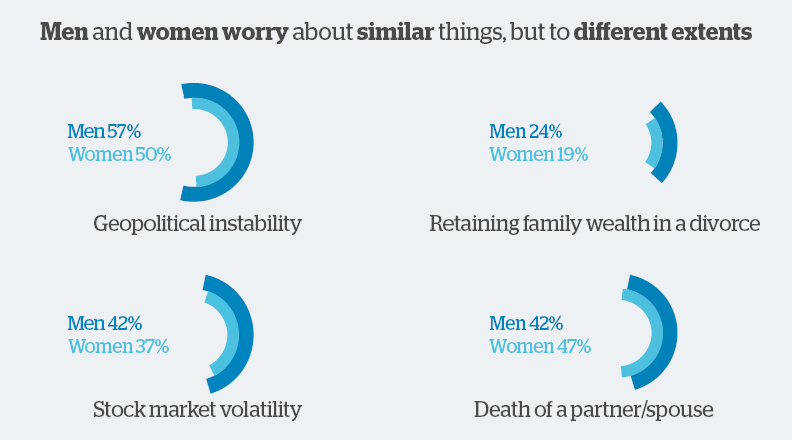

Turning back to gender, we found more patterns that matched 2023’s Wealth Survey results. Men worried more than women about the effects of geopolitical instability and stock market volatility on their financial circumstances (perhaps due to a greater tendency to be investors rather than savers). They were also more worried about retaining family wealth in the event of a divorce. Meanwhile, women once again tended to be slightly more concerned than men about the impact their partner’s death would have on their finances.

Beyond these long-run concerns, Alasdair has found that politics – both global and local – is the topic du jour for both male and female customers:

“As we head into an election year on both sides of the Atlantic, our customers are increasingly concerned about what the US and UK elections will mean for them. For the US election, this is more about how the next White House resident will impact global financial markets, while for the UK election, customers are more concerned with how a new government could impact UK taxation.

“We don’t have a crystal ball, but we do know that financial markets typically look through elections – focusing instead on the economic environment and the behaviour of central banks. And while the potential for changes in tax regimes can seem alarming, rest assured that we’re watchful and ready to advise on any changes to tax rules, always aiming to ensure the most tax-efficient outcomes for our customers.”

Source: Handelsbanken Wealth & Asset Management Wealth Survey 2024

Unpicking the top causes for woe and celebration

As part of our Wealth Survey, we asked people about their biggest financial regrets, and their biggest financial accomplishments.

It turns out, our biggest financial regret is not saving consistently from a young age. Women were slightly more prone to this regret than men (40% of women, compared to 32% of men). This was true for all age groups surveyed. Sticking with the theme of accruing savings, many people also regretted leaving it too late to start a pension, and – on the flipside – incurring too much debt.

Happily, a quarter of our survey respondents told us that they have no financial regrets, rising to 39% for those aged 60+. Taking the chance to get on the property ladder was seen as the biggest financial accomplishment for people across all age groups, along with paying off debt, and saving consistently from a young age.

Alasdair sees it as part of his duty as a wealth adviser to help people to avoid financial regrets wherever possible, and to encourage different generations of savers to share their experiences and knowledge:

“The financial landscape has changed significantly between the youngest adult generations and those who are now retired or retiring. Defined benefit pension schemes are typically no longer the norm, student debt can feel overwhelming, and property prices relative to average salaries make home ownership seem much more out of reach. As a result, younger generations’ financial planning runs the risk of being pushed back by a decade or more while they grapple with nearer-term issues instead of worrying about retirement.

“While it’s easy to see why younger generations might shy away from thinking long-term, we think that building a financial plan can create a solid roadmap and a sense of security and purpose. We’d encourage older generations to share their wisdom (even if that means their regrets!) around issues like building up your pension, as this will become more critical than ever for younger generations too.

Source: Handelsbanken Wealth & Asset Management Wealth Survey 2024

Avoiding regret through sound financial planning

- Don’t let short-term demands on your finances stop you from making a long-term financial plan

- Work with a trusted adviser to ensure your plan is fit for the future, and can weather a range of economic conditions

- Review your plan regularly to ensure it continues to match your personal circumstances and goals

Regrets: a few, or too few to mention?

Click here to view a pdf versionImportant Information

Handelsbanken Wealth & Asset Management Limited is authorised and regulated by the Financial Conduct Authority (FCA) in the conduct of investment and protection business, and is a wholly-owned subsidiary of Handelsbanken plc. For further information on our investment services go to wealthandasset.handelsbanken.co.uk/important-information. Tax advice which does not contain any investment element is not regulated by the FCA. Professional advice should be taken before any course of action is pursued.

- Find out more about our services by contacting us on 01892 701803 or exploring the rest of our website: wealthandasset.handelsbanken.co.uk

- Read about how our investment services are regulated, and other important information: wealthandasset.handelsbanken.co.uk/important-information

- Learn more about wealth and investment concepts in our Learning Zone: wealthandasset.handelsbanken.co.uk/learning-zone/

- Understand more about the language and terminology used in the financial services industry and our own publications through our Glossary of Terms: wealthandasset.handelsbanken.co.uk/glossary-of-terms/

All commentary and data is valid, to the best of our knowledge, at the time of publication. This document is not intended to be a definitive analysis of financial or other markets and does not constitute any recommendation to buy, sell or otherwise trade in any of the investments mentioned. The value of any investment and income from it is not guaranteed and can fall as well as rise, so your capital is at risk.

We manage our investment strategies in accordance with pre-defined risk objectives, which vary depending on the strategy’s risk profile.

Portfolios may include individual investments in structured products, foreign currencies and funds (including funds not regulated by the FCA) which may individually have a relatively high risk profile. The portfolios may specifically include hedge funds, property funds, private equity funds and other funds which may have limited liquidity. Changes in exchange rates between currencies can cause investments of income to go down or up.

Registered Head Office: No.1 Kingsway, London WC2B 6AN. Registered in England No: 4132340