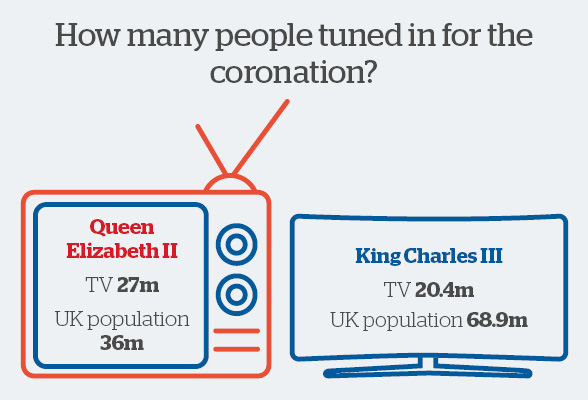

Two monarchs crowned, 70 years apart. In 1953, Queen Elizabeth II’s coronation came in the wake of a global conflict, as the UK turned to face an uncertain post-war future. This year, King Charles III has been crowned following a global pandemic, as a cost of living crisis engulfs the UK population.

But how does King Charles’ coronation landscape shape up next to Queen Elizabeth’s? And what should we expect for the UK in the aftermath of the coronation?

The state of the nation: struggling in a brave new world

Bond prices have undergone huge price falls, having been at the centre of 2022’s market storms. We believe these price falls have created an attractive investment opportunity in UK and US government bonds in particular. With this in mind, we have gradually moved from a smaller position in bonds versus our long-term average and a preference for bonds with more limited sensitivity to interest rate changes, to the opposite stance on both fronts. If we’re right about the economic environment ahead, this should help our strategies’ future performance.

Our position in shares, on the other hand, is currently slightly below our long-term average. At the time of writing, we have not been rewarded for this caution in 2023, but we continue to believe that share prices are not adequately reflecting the impact that an economic slowdown is likely to have on corporate earnings. Share prices are better value than they were a year ago, but we’re still not convinced that they represent good enough value to move to a larger position. We have also upped the ‘quality’ of our stock market positions – favouring shares in businesses which should prove more resilient in a slowing growth environment.

Among our ‘alternative’ assets (i.e. beyond traditional bond and stock markets), our gold positions have benefited this year, amid concerns around stubborn inflation and unrest in the banking sector. We continue to dial down (or exit) alternatives positions where the investment rationale was strong in a low interest rate world, but has since waned (our holding in music royalties is a prime example).

Politics and interest rate expectations have distorted stock markets

1953

Britain began the 1950s in a threadbare state. The cost of fighting World War II had taken its toll on the nation’s coffers, with gold and currency reserves run down, and many overseas assets sold to fund the conflict. The war had also done six years’ worth of damage to UK exports, and redirecting a large proportion of the British workforce to the war effort had left economic growth on the back foot. Rationing was still in place, and there was an acute quality housing shortage.

Against this backdrop, an exhausted nation prepared to celebrate Queen Elizabeth’s coronation. Fortunately, not all was doom and gloom. Higher taxes may have been painful amid post-war poverty, but they had led to the birth of the National Health Service (NHS) in 1948, as well as an expansion in state pensions and social security. Turning an eye to the global stage, on the eve of the coronation, news arrived that Edmund Hillary and Tenzing Norgay (members of a British expedition, of which Prince Philip was patron) had become the first confirmed people to reach the summit of Mount Everest.

2023

The queen’s coronation came in the wake of a world war, but the king’s followed on the heels of a world-changing event of its own. The COVID-19 pandemic claimed the lives of millions, and forced huge evolutions in the way we live, travel and work.

Conflict is still close at hand too: Russia’s ongoing invasion of Ukraine has played out vividly in the backdrop of the post-pandemic world. Besides the terrible human cost of this conflict, it has also contributed (via energy and food markets) to the emergence of a well-publicised ‘cost of living’ crisis. Meanwhile, successive political disasters have engulfed the UK government, and the UK is still struggling to adapt to the post-Brexit era.

Sources: Official viewing figures, The Royal Household

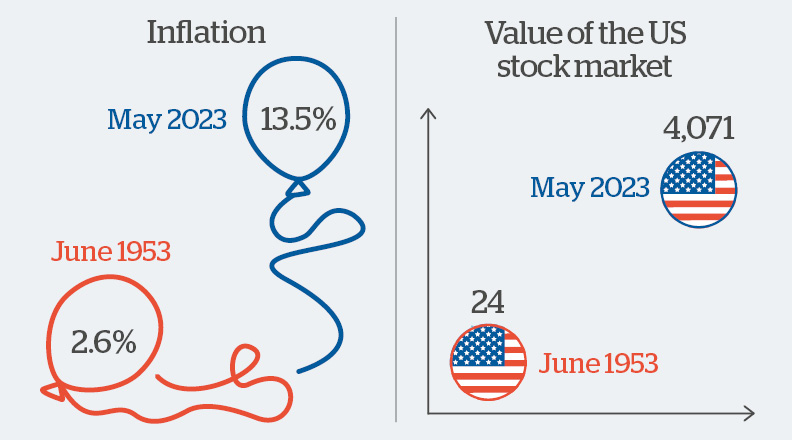

Inflation and interest rates: post-war versus post-pandemic

1953

In the years following World War II, a shortage of goods and the gradual end to price controls pushed consumer costs higher. At the time of the queen’s coronation, inflation (measured by RPI, the Retail Price Index) was running at 2.6%. While this might seem relatively low, this figure came on the heels of double digit inflation just one year earlier, meaning that prices were already elevated, but were now rising less slowly. Against this backdrop, interest rates were set at 3.5%.

2023

At the time of King Charles III’s coronation, inflation was 13.5% (again, measured by RPI). A number of factors played into this, including the wave of pent-up demand for goods and services released following the lockdown era, as well as extremely high energy costs. Most recently, high food costs have been blamed for stubbornly high inflation. Against this backdrop, the Bank of England set interest rates at 4.25% at the time of the coronation (now raised further to 4.5%).

Financial markets: a rapid evolution

1953

When Queen Elizabeth II was crowned, the stock market was incredibly cheap by today’s standards. The most reliable historic data in this regard is probably the S&P 500 Index, which charts the value of the largest US-listed stocks over time. The index doesn’t use currency units like dollars, but instead charts price changes over time through an index value. In June 1953, the index value given to the S&P 500 was 24.

2023

In May 2023, the S&P 500’s index value was 4,071 – dwarfing its 1953 value. During the intervening 70 years, the depth and range of financial markets has also evolved dramatically. Beyond traditional bond and stock markets, an enormous range of new asset types have emerged, from complex hedge funds to niche areas of debt. Thanks to globalisation, technological advances and social change, financial markets have also become much more accessible, and many more people and businesses participate in markets than in 1953.

Retail Price Inflation (RPI) - Source: Bloomberg

S&P 500 Index values - Source: Bloomberg

The aftermath of a coronation: what comes next?

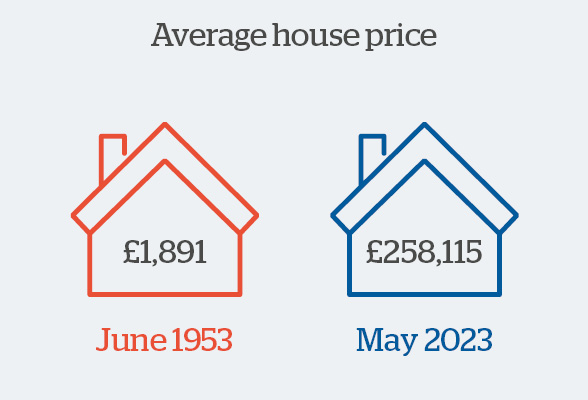

1953

Despite its meagre beginnings, the 1950s played host to some of the UK’s most rapid ever economic growth. A year after the queen’s coronation, inflation had fallen to very low levels, and interest rates had been lowered slightly (from 3.5% to 3%), encouraging economic growth.

By the end of the decade, the economy was booming. Wages and standards of living had risen, urban landscapes were reinvented and rebuilt, and the decade began a sea change in levels of home ownership.

2023

In sharp contrast to the boom years following the queen’s coronation, we think that global growth will slow from here: the inevitable consequence of global central bank policies to rein in inflation. And while we think inflation may have reached its peak, we also think that (contrary to the 1950s) consumers will be obliged to adapt to higher inflation than the ultra-low levels to which we’ve become accustomed in recent years. Similarly, interest rates may be approaching their peak this time around, but the Bank of England is likely to hold them steady for the time being.

Nevertheless, while we anticipate a period of slower growth in the opening chapter of King Charles III’s reign, we would remind readers that the global economy moves in cycles, through periods of expansion and contraction. No outcomes can ever be guaranteed, but if the period of slower economic growth ahead is well managed by global policymakers, and absent another shock, it could create the foundations for a robust recovery to come.

Source: Nationwide House Price Index (Q2 1953 and Q1 2023)

Spotlight on the UK

Click here to view a pdf versionImportant Information

Handelsbanken Wealth & Asset Management Limited is authorised and regulated by the Financial Conduct Authority (FCA) in the conduct of investment and protection business, and is a wholly-owned subsidiary of Handelsbanken plc. For further information on our investment services go to wealthandasset.handelsbanken.co.uk/important-information. Tax advice which does not contain any investment element is not regulated by the FCA. Professional advice should be taken before any course of action is pursued.

- Find out more about our services by contacting us on 01892 701803 or exploring the rest of our website: wealthandasset.handelsbanken.co.uk

- Read about how our investment services are regulated, and other important information: wealthandasset.handelsbanken.co.uk/important-information

- Learn more about wealth and investment concepts in our Learning Zone: wealthandasset.handelsbanken.co.uk/learning-zone/

- Understand more about the language and terminology used in the financial services industry and our own publications through our Glossary of Terms: wealthandasset.handelsbanken.co.uk/glossary-of-terms/

All commentary and data is valid, to the best of our knowledge, at the time of publication. This document is not intended to be a definitive analysis of financial or other markets and does not constitute any recommendation to buy, sell or otherwise trade in any of the investments mentioned. The value of any investment and income from it is not guaranteed and can fall as well as rise, so your capital is at risk.

We manage our investment strategies in accordance with pre-defined risk objectives, which vary depending on the strategy’s risk profile.

Portfolios may include individual investments in structured products, foreign currencies and funds (including funds not regulated by the FCA) which may individually have a relatively high risk profile. The portfolios may specifically include hedge funds, property funds, private equity funds and other funds which may have limited liquidity. Changes in exchange rates between currencies can cause investments of income to go down or up.

This document has been issued by Handelsbanken Wealth & Asset Management Limited. For Handelsbanken Multi Asset Funds, the Authorised Corporate Director is Handelsbanken ACD Limited, which is a wholly-owned subsidiary of Handelsbanken Wealth & Asset Management, and is authorised and regulated by the Financial Conduct Authority (FCA). The Registrar and Depositary is The Bank of New York Mellon (International) Limited, which is authorised by the Prudential Regulation Authority and regulated by the FCA. The Investment Manager is Handelsbanken Wealth & Asset Management Limited, which is authorised and regulated by

the FCA.

Before investing in a Handelsbanken Multi Asset Fund you should read the Key Investor Information Document (KIID) as it contains important information regarding the fund including charges and specific risk warnings. The Prospectus, Key Investor Information Document, current prices and latest report and accounts are available from the following webpage: wealthandasset.handelsbanken.co.uk/fund-information/fund-information/, or you can request these from Handelsbanken Wealth & Asset Management Limited or Handelsbanken ACD Limited: 77 Mount Ephraim, Tunbridge Wells, Kent, TN4 8BS or by telephone on

+44 01892 701803.

Registered Head Office: No.1 Kingsway, London WC2B 6AN. Registered in England No: 4132340