Change has been building in the energy sector, as public pressure and environmental necessity are driving forward a shift to more sustainable forms of fuel.

The transition to renewable energy has begun, but to build momentum and achieve a cleaner world for the long term, this change needs government support, regulatory backup, and – of course – investment. Handled well, the energy transition has the potential to pay off for society, the planet, and its investors.

What is the ‘energy transition’?

The ‘energy transition’ is a dramatic shift in the way we produce and consume energy. It refers to a move away from traditional, fossil-fuel-based energy (like oil, coal and gas), towards renewable energy supplies (like solar, wind and biomass). The energy transition requires a change in the infrastructure surrounding our energy sources, as well as the sources themselves.

Who is leading the charge?

At a regulatory level, Europe and the US have led the charge so far. The scale of their recent energy transition packages – which provide critical support to the energy transition – cannot be overstated.

REPower EU

In response to the disruptive effects of Russia’s invasion of Ukraine, the REPower EU plan aims to end the EU’s energy dependence on Russian fossil fuels, as well as advancing the fight against climate change. The plan includes €300bn of investment by 2030.

Inflation Reduction Act

Something of a trick shot by President Biden’s administration (because which US politician could vote against legislation named the ‘Inflation Reduction Act’?), this legislation provides long-term subsidies for sustainable energy generation and ‘clean’ manufacturing in the US. The legislation includes $369bn in funding and significant tax credits.

EU Industrial Strategy

Born out of the European Green Deal, the EU Industrial Strategy aims to drastically increase Europe’s renewable energy capability (involving €1trn of investment), fast-track project permits, and prioritise ‘home-grown’ sources of renewable energy.

But while Western economies have led the way with greener legislation, the energy transition is a global theme. Media coverage often frames developing economies as rogue perpetual polluters, but the truth is not so black and white. Recently industrialised nations have had a tendency to lean on fossil fuels to turbocharge their economies, but there are also signs that these nations have ambitions to pivot to cleaner energy too. For example, China has accounted for over half of the world’s wind power installations since 2020, and India has been steadily increasing its solar power installations over the past decade.

There’s still much more to do…

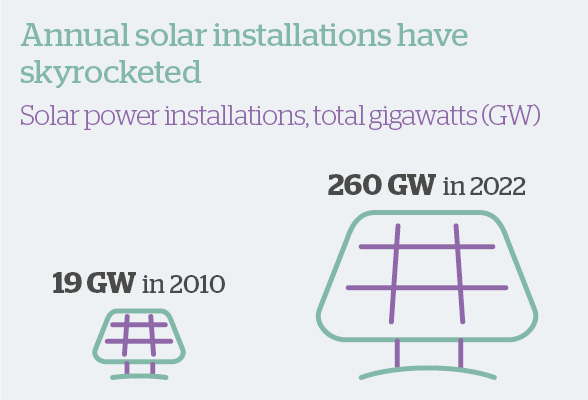

New regulatory announcements have added significant momentum to the goal of decarbonisation. At this point, it’s important to note that the energy transition isn’t just a pipe dream that the world is optimistically planning for: it’s already happening.

However, there is still a long way to go. For example, creating a globally coherent approach to achieving the energy transition remains problematic. At a recent meeting of the G7 (UK, US, Germany, France, Japan, Italy and Canada), leaders were criticised by climate change experts for failing to set a deadline to phase out coal power. It’s worth nothing, though, that the group did reiterate their commitment to accomplishing predominantly or fully decarbonised power by 2035.

There is also, of course, the not-insignificant matter of adequately funding the energy transition. Despite the financial commitments already in place through new regulation, the sheer level of investment required from this point is staggering. To get on course for ‘net zero’, i.e. achieving a balance between carbon emitted into and removed from the atmosphere, investment in clean energy may need to rise from its current levels of a little above $1trn per year, to $4.5trn.¹

¹IRENA, Guinness Global Investors estimates; April 2023

Source: Guinness Global Investors

Source: Guinness Global Investors. 2022 data is estimated

... which presents long-term opportunities for investors

We know that there is public, political and – of course – environmental pressure to transition the world to renewable, sustainable energy. Huge investment is already taking place, but much more is still to come. We strongly believe that this presents an attractive, long-term opportunity for investors.

The transition to renewable energy will encompass a huge range of investable areas. Naturally, more renewable energy needs to be generated, and this means investing across the spectrum of renewable energy sources, from wind and solar to hydro (water), geothermal and biomass sources. The International Energy Agency estimates that by 2025, renewable sources will generate a larger supply of electricity than coal, gas or nuclear sources.

As well as the possibility of investing directly in this renewable energy production, investors also have the ability to invest in government bonds issued to support clean energy projects. The ‘green gilts’ recently issued by the UK government to fund renewable energy initiatives and generate UK jobs in the renewable energy sector are just one example.

But generating more renewable energy is just part of the story. Energy generated from renewable sources needs to be stored, particularly as these sources can be uneven (e.g. in simple terms, when the wind drops, so does the power generated by wind farms). Modern populations rely on (and expect) consistency from their energy supply, so a means of storing renewable energy is essential in order to even out its distribution. Traditional fossil fuel storage methods (like tanks and silos) have no use in the renewable energy sector. Instead, investment in battery technology and battery storage facilities is essential, and investment opportunities are already opening up in this fast-paced and innovative area.

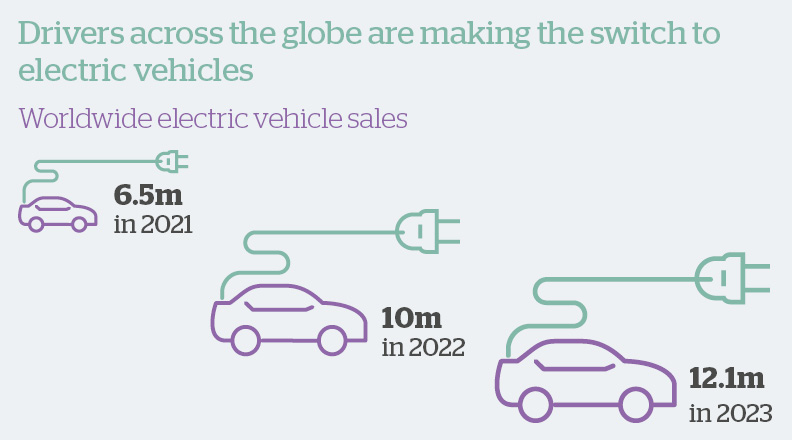

Renewable energy also needs different methods of distribution and consumption. Electric vehicles and their required charging stations are an obvious example of this. Despite some well-documented teething troubles, the infrastructure is being built all around us to accommodate a greener fleet of vehicles. As both regulation and infrastructure increasingly support the switch to electric vehicles, this is another key trend for investors to access.

Source: EV-Sales. 2023 data is estimated

How are we invested in the energy transition?

Our sustainable investment strategies are already taking part in the energy transition, with investments across both stock and bond markets, as well as in ‘alternative’ asset types (which lie beyond traditional financial markets). From generation to storage, from ‘green gilts’ to electric vehicles, these investments are backing long-term growth in the renewable energy sector, and supporting the transition to a more sustainable future.

Sustainable investing

Click here to view a pdf versionImportant Information

Handelsbanken Wealth & Asset Management Limited is authorised and regulated by the Financial Conduct Authority (FCA) in the conduct of investment and protection business, and is a wholly-owned subsidiary of Handelsbanken plc. For further information on our investment services go to wealthandasset.handelsbanken.co.uk/important-information. Tax advice which does not contain any investment element is not regulated by the FCA. Professional advice should be taken before any course of action is pursued.

- Find out more about our services by contacting us on 01892 701803 or exploring the rest of our website: wealthandasset.handelsbanken.co.uk

- Read about how our investment services are regulated, and other important information: wealthandasset.handelsbanken.co.uk/important-information

- Learn more about wealth and investment concepts in our Learning Zone: wealthandasset.handelsbanken.co.uk/learning-zone/

- Understand more about the language and terminology used in the financial services industry and our own publications through our Glossary of Terms: wealthandasset.handelsbanken.co.uk/glossary-of-terms/

All commentary and data is valid, to the best of our knowledge, at the time of publication. This document is not intended to be a definitive analysis of financial or other markets and does not constitute any recommendation to buy, sell or otherwise trade in any of the investments mentioned. The value of any investment and income from it is not guaranteed and can fall as well as rise, so your capital is at risk.

We manage our investment strategies in accordance with pre-defined risk objectives, which vary depending on the strategy’s risk profile.

Portfolios may include individual investments in structured products, foreign currencies and funds (including funds not regulated by the FCA) which may individually have a relatively high risk profile. The portfolios may specifically include hedge funds, property funds, private equity funds and other funds which may have limited liquidity. Changes in exchange rates between currencies can cause investments of income to go down or up.

This document has been issued by Handelsbanken Wealth & Asset Management Limited. For Handelsbanken Multi Asset Funds, the Authorised Corporate Director is Handelsbanken ACD Limited, which is a wholly-owned subsidiary of Handelsbanken Wealth & Asset Management, and is authorised and regulated by the Financial Conduct Authority (FCA). The Registrar and Depositary is The Bank of New York Mellon (International) Limited, which is authorised by the Prudential Regulation Authority and regulated by the FCA. The Investment Manager is Handelsbanken Wealth & Asset Management Limited, which is authorised and regulated by

the FCA.

Before investing in a Handelsbanken Multi Asset Fund you should read the Key Investor Information Document (KIID) as it contains important information regarding the fund including charges and specific risk warnings. The Prospectus, Key Investor Information Document, current prices and latest report and accounts are available from the following webpage: wealthandasset.handelsbanken.co.uk/fund-information/fund-information/, or you can request these from Handelsbanken Wealth & Asset Management Limited or Handelsbanken ACD Limited: 77 Mount Ephraim, Tunbridge Wells, Kent, TN4 8BS or by telephone on

+44 01892 701803.

Registered Head Office: No.1 Kingsway, London WC2B 6AN. Registered in England No: 4132340