All investors’ personal circumstances are different.

However, their financial objectives probably fit into one or more of the following categories:

Capital preservation | Protecting the wealth you have |

Income generation | Drawing an income from your wealth |

Capital growth | Growing the value of your wealth |

Responsible investing | Doing good for the planet and/or society while you invest |

Which financial objective is right for me?

Ultimately, the choice selected is likely to depend on answers to common questions, such as:

- What’s your investment timeframe?

- How much can you regularly invest?

- How much risk are you willing to take on to maximise your potential reward?

- Are you likely to need to access your funds at short notice?

Changing circumstances (a change of income, marriage, divorce, retirement or bereavement) could (and indeed should!) result in a reassessment of your objectives.

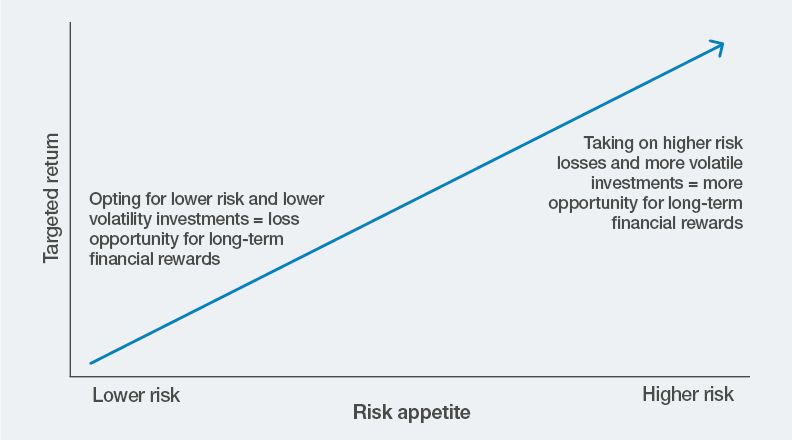

The important thing to remember is that objectives are goals, not guarantees, and all objectives (indeed all forms of investment) require taking on some risk. This is an essential part of investment markets and that without it, there can be no potential for attractive investment returns. This should always be a major consideration for investors choosing a suitable objective.

The risk versus return trade-off

Considered the most risk averse objective, this is best suited to investors who want to take on relatively low levels of risk when they invest their capital.

A capital preservation objective equates to the aim of preventing loss. This is usually targeted by investing in traditionally safer asset types like high quality government bonds, cash and gold.

Yet low risk does not mean no risk:

- In particular, factors like high inflation can have a particularly detrimental effect on strategies focused on capital preservation. This is because when interest is paid on assets like bonds and cash, it is usually a fixed payout. When inflation rises above these interest rates, these assets are effectively worth less than they were before.

- Taking a lower risk approach to investing also typically means moderating your expectations for long-term rewards, as your manager will prioritise protecting your capital rather than taking additional risk in an effort to grow it.

Income investing aims to generate an income stream for investors over the longer term. This is usually achieved by investing in assets which pay income through interest payments (such as government bonds) or via shareholder dividends. When it comes to the latter, a number of stock market sectors – utilities, communication services and consumer staples (which includes foods and household goods) – are especially associated with dividend payments.

Risks associated with income investing:

- A key challenge for fund managers is to create a consistent stream of income over time for their investors, especially if inflation is high (reducing the real-world value of interest payments on bonds or cash) or if shareholder dividend payments are cut in response to company performance or economic events.

- It’s worth noting too that by withdrawing income from their investments, income investors are also likely to miss out on the longer-term benefits of reinvestment and compounding.

Investing for capital growth is a higher risk approach, where more risk is taken on in an effort to build up an investment pot more quickly. The choices of investible assets suitable for a growth profile are wide and could include high growth companies and niche alternative assets like higher risk hedge funds. Highly valued assets which have performed well can continue to benefit from having a competitive advantage or dominating a particular sector. For example, in the early 2020s, the growth in artificial intelligence (AI) has resulted in significant returns in the technology sector. However, past performance is never a reliable guide to future returns, and a change in the stock market fortunes of high growth companies can be painful.

There are two main risks associated with investing for capital growth:

- In the event of a broad market correction, highly valued growth shares will be at risk of a greater downturn than more moderately priced assets.

- Even when they are highly successful, growth style companies tend to have a very limited dividend policy. Many do not pay any dividends to shareholders at all. Focusing solely on the capital appreciation potential of these assets can prove very risky if company news flow becomes disappointing.

It’s increasingly popular to invest with more than purely financial gain in mind. Many investors also want to know that their capital is doing good – or at least not actively doing harm. With this in mind, a growing number of funds include environmental and/or social goals in their objectives. They might invest in companies, sectors and countries which demonstrate a positive influence on environmental and/or societal themes, whilst seeking to avoid investment in activities considered harmful.

Some of the main risks associated with responsible investing relate to the structure of the market for responsible assets:

- The global pool of responsible investment options has grown in recent years, and more products are coming to the market all the time. However, responsible assets still represent a much smaller pool of assets versus the entirety of the global marketplace for investors. Despite significant diversity between responsible assets, there’s no denying that fishing in this smaller pool reduces the options for investment managers.

- Businesses focused on sustainability may be impacted by factors less likely to hinder other areas of global financial markets, such as political agendas and changes to environmental regulations and incentives.

- As a relatively younger area of the market, responsible assets are typically small or mid-sized in scale, meaning that in periods when the share prices of larger companies dominate the market, they are likely to be left behind in performance terms.

Can I have more than one investment objective?

Of course, and many investors do. While it may be easy to categorise individuals by an investment and style based on their income, risk tolerance or personal circumstances, the representative fund objectives featured above should be taken only as a general guide.

Many investment strategies blend multiple objectives and styles together to address the goals of a range of customers. You might want to protect your capital, whilst receiving an income. Perhaps you want to invest in assets focused on positive environmental and social outcomes, whilst allowing room for potential growth.

Whatever your gut feeling, it’s important to ensure you’re receiving the right advice, and are choosing the most suitable investment approach for your own tastes and circumstances.

If you’d like to find out more about investing, please continue to explore our Learning Zone, where we have more resources on a range of investment topics.

Important Information

Handelsbanken Wealth & Asset Management Limited is authorised and regulated by the Financial Conduct Authority (FCA) in the conduct of investment and protection business, and is a wholly-owned subsidiary of Handelsbanken plc. For further information on our investment services go to wealthandasset.handelsbanken.co.uk/important-information. Tax advice which does not contain any investment element is not regulated by the FCA. Professional advice should be taken before any course of action is pursued.

- Find out more about our services by contacting us on 01892 701803 or exploring the rest of our website: wealthandasset.handelsbanken.co.uk

- Read about how our investment services are regulated, and other important information: wealthandasset.handelsbanken.co.uk/important-information

- Learn more about wealth and investment concepts in our Learning Zone: wealthandasset.handelsbanken.co.uk/learning-zone/

- Understand more about the language and terminology used in the financial services industry and our own publications through our Glossary of Terms: wealthandasset.handelsbanken.co.uk/glossary-of-terms/

All commentary and data is valid, to the best of our knowledge, at the time of publication. This document is not intended to be a definitive analysis of financial or other markets and does not constitute any recommendation to buy, sell or otherwise trade in any of the investments mentioned. The value of any investment and income from it is not guaranteed and can fall as well as rise, so your capital is at risk.

We manage our investment strategies in accordance with pre-defined risk objectives, which vary depending on the strategy’s risk profile.

Portfolios may include individual investments in structured products, foreign currencies and funds (including funds not regulated by the FCA) which may individually have a relatively high risk profile. The portfolios may specifically include hedge funds, property funds, private equity funds and other funds which may have limited liquidity. Changes in exchange rates between currencies can cause investments of income to go down or up.

Registered Head Office: No.1 Kingsway, London WC2B 6AN. Registered in England No: 4132340