We offer four global responsible multi asset funds catering to a spectrum of different risk preferences. The funds aim to deliver financial returns to our customers over the long term.

The responsible funds are actively managed within the same investment process as our core funds, while the responsible credentials of a potential investment are assessed against our Responsible Investment Policy. All investments are tested against the policy’s criteria by our Responsible Investment Committee.

The full policy is available here.

How we approach responsible investing

Our approach to responsible investing is to pursue investment in companies, sectors and countries that demonstrate a positive influence on environmental and/or social themes. At the same time, we seek to avoid investment in activities that we consider harmful to the environment and/or society.

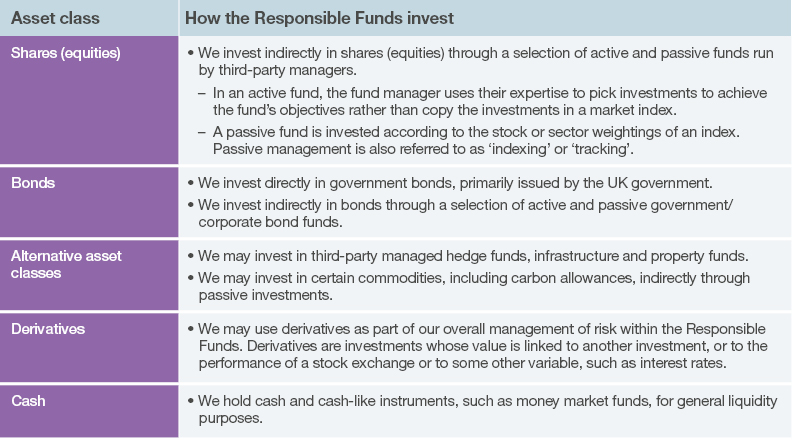

The responsible funds have a multi-asset investment approach, meaning their portfolios have exposure to a range of asset classes. The responsible funds usually access asset classes ‘indirectly’ through investment in other funds. These funds are pooled investment vehicles, where one large portfolio is funded by numerous different investors and invested into different underlying assets, including funds managed by third-party fund managers.

We have listed the asset classes used in the responsible funds, and how we invest in each of them, below:

Our responsible investing framework

We use a responsible investing framework to assess, select and monitor the third-party managers and issuers of the investments that we select for the responsible funds. The framework comprises four underlying components:

- ESG (environmental, social and governance) integration

- Negative screening

- Pursuing positive environmental and/or social themes

- Engagement

All assets held in the responsible funds are subject to our ESG integration assessment and negative screening.

Our aim is that at least 70% (65% for the Handelsbanken Defensive Responsible Multi Asset Fund) of the assets within the responsible funds shall meet our criteria for demonstrating positive environmental and/or social themes.

As the responsible funds usually invest in funds managed by third-party managers, we assess the engagement processes of those third-party managers, and their engagement with investee companies or issuers.

Handelsbanken Wealth & Asset Management and The UK Sustainable Investment and Finance Association

We are proud to be a member of The UK Sustainable Investment and Finance Association (UKSIF), as a way of demonstrating our commitment to creating a more responsible finance system in the UK. UKSIF membership allows us to collaborate on pioneering new research within UKSIF projects, and also gives us access to knowledge on emerging issues and key contacts within the responsible investment industry.

Find our more about each of our individual responsible multi asset funds

Statement on Sustainable Investment Label

UK investment products that have sustainability characteristics can choose to use a sustainable investment label as defined by the FCA, if the product meets certain criteria. Sustainable investment labels help investors identify products that have a specific sustainability goal.

These products do not have a UK sustainable investment label. This is because the Portfolio Manager does not invest the Sub-funds' assets in accordance with a specific sustainability objective, which is a requirement for products where the manager has chosen to use a sustainable investment label.

Responsible Investment Policy

Find out more about our core and income funds