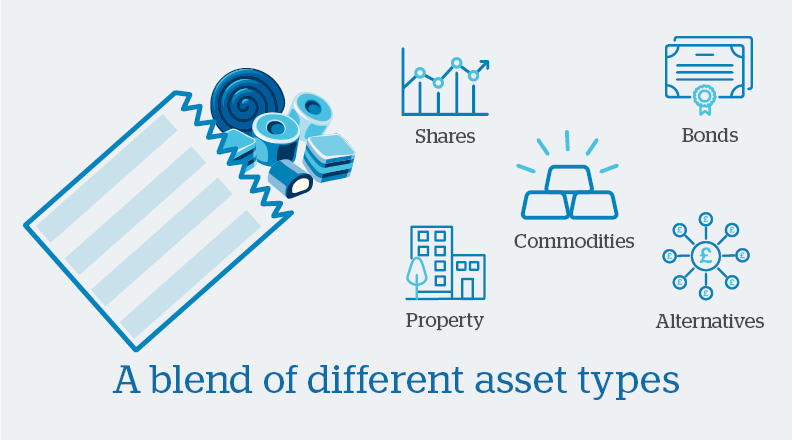

Taking a multi asset approach to investing means combining different types of assets, such as shares, bonds and alternatives assets, as well as cash.

Why do investors choose a multi asset approach?

Diversify your investments

Multi asset investing is an embodiment of the term ‘don’t put all your eggs in one basket’, in that it values diversification.

Different asset classes, regions and sectors, will respond to market activity in various ways. So if part of a multi asset investment portfolio underperforms, the spread of other holdings means the fund is unlikely to be severely affected. (However, it’s worth noting that the opposite also applies: if a single investment performs very strongly, the positive impact of this strong performance will be diluted!)

Aim for a smoother investment journey

Investing across a range of asset types should – in theory – create a smoother investment journey. This is because the diverse types of assets within a multi asset fund are likely to behave in different ways during different financial market conditions.

For example, government bonds and shares in developing economies might react in different ways to news of a change in interest rates, or a geopolitical crisis. Since the assets held are unlikely to perform in a similar way to one another, a multi asset approach should also go some way towards mitigating the risk of major portfolio losses should one asset class or investment underperform.

Target a specific investment outcome

Variety among multi asset investment options is important, as not all multi asset investors are looking to achieve the same outcomes. Different multi asset funds could be suitable for those seeking to achieve specific investment outcomes, such as:

- Growing their invested money

- Achieving a targeted financial return

- Receiving an income from their investments

- Building their retirement savings

- Investing sustainably

It’s important to remember that – whatever the intended outcomes – whatever you do with your money (even saving it in cash) will incur some risks. It’s crucial to ensure that you understand what you have invested in, and the risks your chosen option involves.

History

Underpinning multi asset investing is the long-standing investment concept of diversification. During the 1960s and 1970s, a 60:40% ‘balanced portfolio’ – split between 60% in shares and 40% in bonds – was the simple and dominant form of multi asset investing.

This concept was refined during the 1980s, as investment thinking evolved towards a belief that asset allocation (the balance of asset types included within an investment portfolio), rather than specific share selection or market timing, could be responsible for the performance of that investment portfolio. This contributed to the growth and choice available in multi asset funds.

Today, multi asset funds are popular vehicles for long-term investors, offering a great deal of flexibility regarding asset selection and risk profile, while managing exposure to risks where possible.

Do multi asset managers think long term or short term?

We’d always advise our customers to take a long-term approach, allowing their investment time to go to work in financial markets.

Reflecting the complexity involved in running a multi asset portfolio, multi asset investments are commonly promoted using ‘off-the-shelf’ funds, managed by investment managers. They are designed to make a potentially complex way of investing simple for investors. Customers are then able to invest in these funds to create a single investment solution, if this meets their needs.

Your asset managers should aim to manage your money with an eye on both long-term strategic considerations and short-term tactical opportunities:

This is the long-term mindset behind the investment vehicle. The fund’s managers will consider which blend of asset types will be optimal to achieving the fund’s stated outcomes over the coming period. Assumptions about economic issues like future inflation and interest rates will be important.

More narrow ‘tactical’ decision making takes place when managers adjust the investment portfolio to take account of market fluctuations or investment opportunities, perhaps attempting to capture an attractive buying opportunity or avoid a near-term pitfall. Despite their complexity, multi asset funds can often be quickly readjusted to take account of anticipated changes in market conditions.

The manager might use complex techniques, including options, futures and currency hedging, to help achieve their desired investment outcome.

Multi asset funds can have higher fees for customers, compared with products focused on just one type of asset (like shares or bonds). This should reflect the management expertise required to select the assets in the fund, and the types of investment chosen.

Is multi asset investing risky?

All forms of investing incur some risk, even cash, whose value can be eroded by inflation. The level of risk associated with a particular asset is linked to the return that it might achieve – in short, investors will want to be rewarded for their willingness to invest in more risky investments such as shares, compared to more cautious investors who prefer lower risk assets such as bonds and cash. It should be noted that investors’ tolerance for risk (in exchange for potential financial reward) will differ depending on their personal circumstances and investment goals.

By investing across different asset types, multi asset investors can spread out the risk and return generated over time. In this way, multi asset investments can deliver longer-term investment returns linked to lower levels of risk than a fund invested in – for example – purely stock market investments. While there are never any guarantees with any form of investing, overall, the result should be a smoother long term investment journey, typically with lower volatility.

If you’d like to find out more about the types of financial assets and investing, please continue to explore our Learning Zone, where we have more resources on topic like this one.

Important Information

Handelsbanken Wealth & Asset Management Limited is authorised and regulated by the Financial Conduct Authority (FCA) in the conduct of investment and protection business, and is a wholly-owned subsidiary of Handelsbanken plc. For further information on our investment services go to wealthandasset.handelsbanken.co.uk/important-information. Tax advice which does not contain any investment element is not regulated by the FCA. Professional advice should be taken before any course of action is pursued.

- Find out more about our services by contacting us on 01892 701803 or exploring the rest of our website: wealthandasset.handelsbanken.co.uk

- Read about how our investment services are regulated, and other important information: wealthandasset.handelsbanken.co.uk/important-information

- Learn more about wealth and investment concepts in our Learning Zone: wealthandasset.handelsbanken.co.uk/learning-zone/

- Understand more about the language and terminology used in the financial services industry and our own publications through our Glossary of Terms: wealthandasset.handelsbanken.co.uk/glossary-of-terms/

All commentary and data is valid, to the best of our knowledge, at the time of publication. This document is not intended to be a definitive analysis of financial or other markets and does not constitute any recommendation to buy, sell or otherwise trade in any of the investments mentioned. The value of any investment and income from it is not guaranteed and can fall as well as rise, so your capital is at risk.

We manage our investment strategies in accordance with pre-defined risk objectives, which vary depending on the strategy’s risk profile.

Portfolios may include individual investments in structured products, foreign currencies and funds (including funds not regulated by the FCA) which may individually have a relatively high risk profile. The portfolios may specifically include hedge funds, property funds, private equity funds and other funds which may have limited liquidity. Changes in exchange rates between currencies can cause investments of income to go down or up.

Registered Head Office: 25 Basinghall Street, London EC2V 5HA. Registered in England No: 4132340