Our funds aim to deliver long-term financial returns

Our objective is simple: to deliver long-term financial returns, in exchange for taking on an appropriate level of risk.

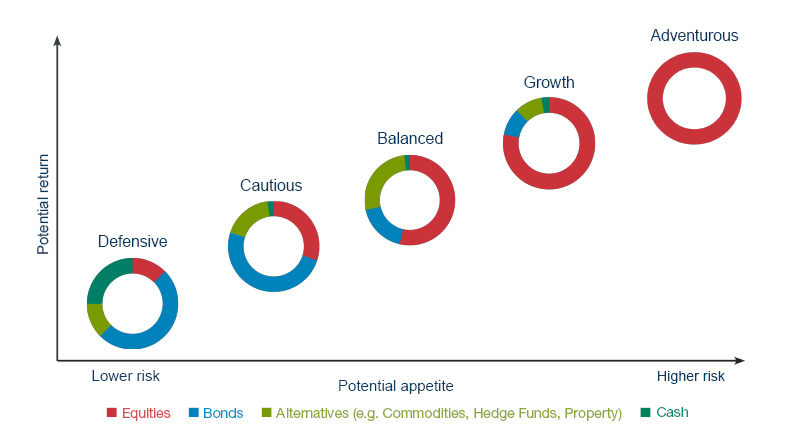

The five funds making up our core funds range cater to a spectrum of different risk preferences.

Building an appropriate mix of assets to achieve your goals

The mix of investments used in our funds showcases our expertise in selecting a range of different asset types. This includes investments intended to diversify risk (such as developed world government bonds), as well as those focused on driving financial returns (such as global shares).

Dynamically selected asset blends to match chosen risk and return levels

Source: Handelsbanken Wealth & Asset Management

Four of our five core funds take a ‘multi asset’ approach, which means that they invest in a blend of financial asset types, from shares and government bonds to ‘alternative’ assets.

Our lower risk multi asset funds include a greater proportion of lower risk assets like bonds:

- Find out more about our Defensive fund

- Find out more about our Cautious fund

Our higher risk multi asset funds include a greater proportion of higher risk assets like shares (equities):

- Find out more about our Balanced fund

- Find out more about our Growth fund

Our fifth core fund is also our highest risk approach. This is designed for our most pro-risk investors, and focuses exclusively on shares (equities):

- Find out more about our Adventurous fund